Blitz News Digest

Stay updated with the latest trends and insights.

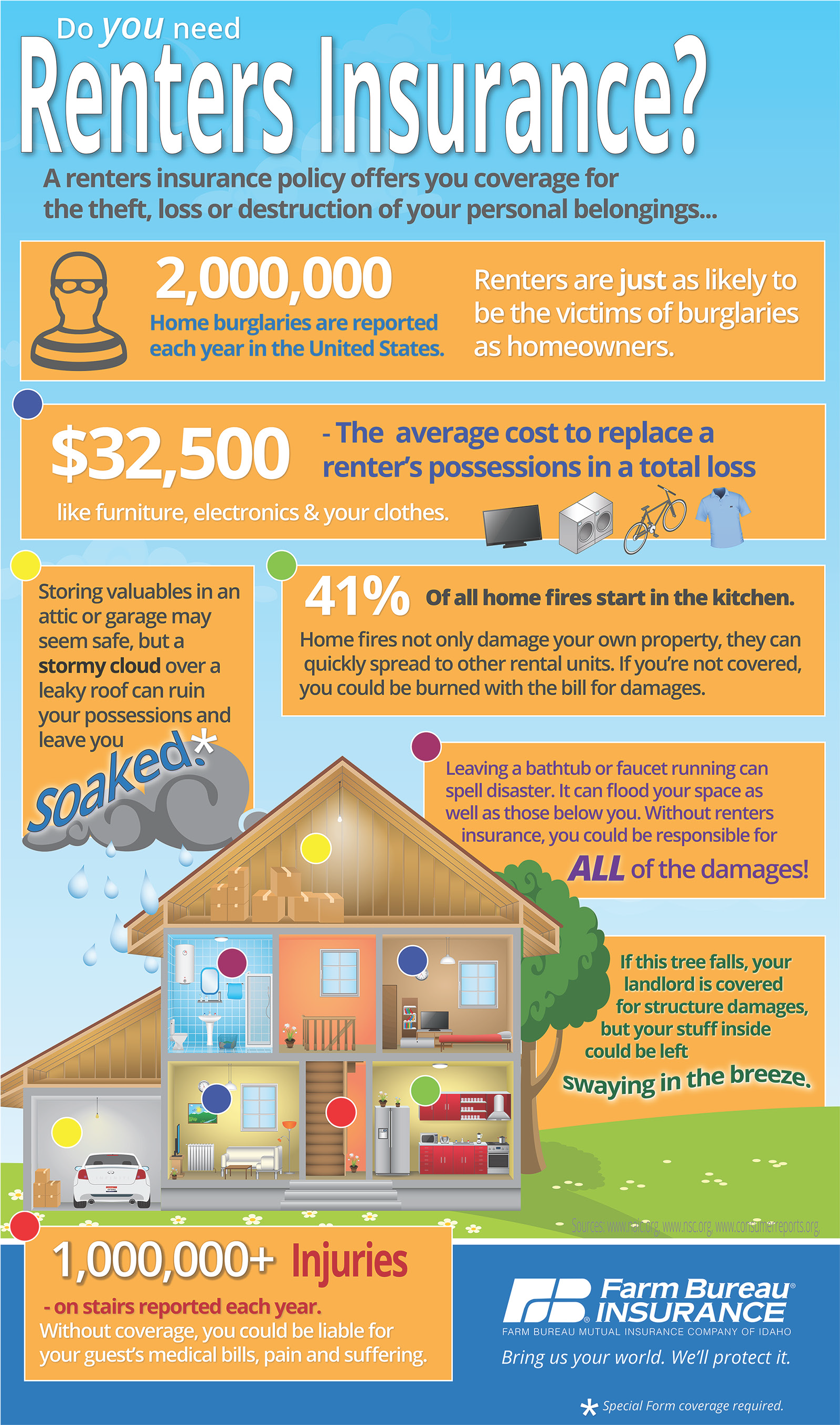

Why Your Landlord's Insurance Isn't Enough to Keep You Safe

Discover the surprising truth: Your landlord's insurance won't protect you! Learn how to safeguard yourself today!

Understanding the Gaps: Why Landlord's Insurance May Leave You Unprotected

Landlord's insurance is an essential tool for property owners, providing coverage for various risks associated with rental properties. However, it's crucial to understand the gaps in this type of insurance, as many landlords mistakenly believe they are fully protected. Common exclusions from coverage can leave landlords vulnerable to significant financial losses. For instance, standard policies often do not cover damages caused by natural disasters, tenant-related issues, or even certain types of liability claims. This oversight can lead to devastating consequences if a major incident occurs, underscoring the importance of thoroughly reviewing your policy.

Another critical aspect to consider is that landlord's insurance does not always include coverage for lost rental income during periods of vacancy or repairs. If a tenant breaks their lease or if significant damage requires extensive repairs, landlords may struggle financially without this essential protection. Additionally, many landlords underestimate the potential liabilities that arise from tenant activities, leading to costly court proceedings or settlements that the insurance policy does not cover. By recognizing these potential pitfalls and seeking comprehensive coverage options, landlords can better safeguard their investments and ensure they are not left unprotected.

5 Critical Risks Landlord's Insurance Doesn't Cover

Landlord's insurance is essential for property owners looking to protect their investment. However, it's important to recognize that such policies often come with limitations. One critical risk that many landlords overlook is liability for tenant injuries. While most policies cover general liability, they might not protect against specific incidents like slips and falls, especially if negligent maintenance is involved. Tenants might seek compensation for medical bills, lost wages, and other damages, leaving landlords vulnerable to expensive legal costs.

Another significant gap in coverage pertains to natural disasters like floods or earthquakes. Many landlords mistakenly believe their policy includes protection against all types of property damage; yet, standard landlord's insurance does not cover damages from these catastrophic events. To safeguard against such risks, landlords must consider additional coverage options or separate policies, ensuring their properties are not left exposed to financial loss from unforeseen natural calamities.

Is Your Safety at Stake? The Hidden Dangers of Relying Solely on Landlord's Insurance

When it comes to protecting your home and belongings, relying solely on landlord's insurance may leave you vulnerable to significant risks. Many tenants mistakenly assume that their landlord's policy covers all potential hazards, from theft to fire damage. However, landlord insurance primarily protects the property owner against losses related to the building itself and liabilities arising from the premises. This means that in the event of unforeseen incidents, such as a burst pipe or an electrical fire, tenants may find themselves facing hefty out-of-pocket expenses for their personal belongings and living arrangements.

Moreover, the fine print of landlord policies often excludes coverage for specific situations. For example, if a guest is injured in your apartment due to negligence on the part of the landlord, the insurance might not extend to your personal liability, leaving you exposed to lawsuits and financial burdens. Additionally, relying solely on landlord's insurance can lead to complacency, preventing tenants from taking proactive measures to secure their own safety and assets. To mitigate these hidden dangers, consider investing in renters' insurance, which specifically caters to your needs and provides comprehensive coverage for your valuable items and liability risks.