Blitz News Digest

Stay updated with the latest trends and insights.

Why Renters Insurance is Your New Best Friend

Discover how renters insurance can protect your belongings and save you from financial headaches—your new best friend in renting!

Top 5 Reasons Why Renters Insurance is Essential for Your Peace of Mind

Renters insurance is often overlooked by tenants, yet it plays a crucial role in safeguarding your belongings and ensuring peace of mind. Here are the top 5 reasons why having renters insurance is essential:

- Protection Against Theft: In the event of a burglary, renters insurance can help you recover the value of stolen items, alleviating the financial burden.

- Covers Damages: If your personal belongings are damaged due to unforeseen events like fire or water leaks, renters insurance can cover replacement costs, ensuring you don’t have to bear the full expense.

Furthermore, renters insurance isn't just about belongings; it also provides liability coverage. This means that if someone is injured in your rental space, the policy can help cover legal expenses or medical bills, giving you peace of mind. Peace of Mind comes from knowing you are protected. By investing in renters insurance, you not only protect your physical belongings but also secure your financial future from unpredictable events.

- Affordable Premiums: Renters insurance is generally inexpensive, making it a wise investment for anyone renting a home.

- Requirement for Leasing: Many landlords now require tenants to carry renters insurance, making it a necessity for securing your lease.

What Does Renters Insurance Cover? A Complete Guide for Tenants

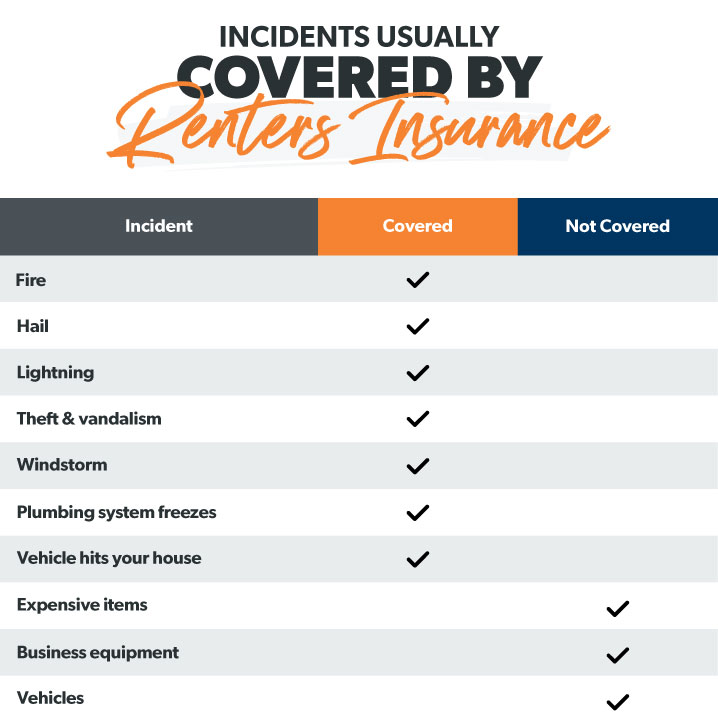

Understanding what renters insurance covers is essential for every tenant looking to protect their belongings. Typically, renters insurance provides coverage for personal property, which includes items like furniture, electronics, and clothing. In the event of theft, fire, or certain natural disasters, your policy will help reimburse you for the loss of these items up to your coverage limit. Additionally, renters insurance often offers liability coverage, protecting you if someone is injured in your rented space, or if you accidentally cause damage to someone else's property.

Moreover, many renters insurance policies also include additional living expenses coverage. This means that if your rented home becomes uninhabitable due to a covered incident, your policy may help cover the costs of temporary accommodation, food, and other necessary expenses. It's important to read your policy carefully, as coverage can vary significantly between providers and specific plans. Therefore, always ensure you understand the terms and limits of your policy to truly benefit from renters insurance.

Is Renters Insurance Worth It? Debunking Common Myths and Misconceptions

When considering whether renters insurance is worth it, many individuals often fall prey to common myths and misconceptions. One prevalent belief is that insurance is unnecessary since a landlord's policy covers damages to the property. However, it's crucial to understand that a landlord's insurance only covers the building itself, not your personal belongings. In fact, renters insurance provides financial protection for your possessions, covering losses due to theft, fire, or water damage. This means that if unexpected events occur, you will not be left vulnerable to replacing your belongings out of pocket.

Another myth suggests renters insurance is expensive and not cost-effective. In reality, the average cost of renters insurance is quite low, typically ranging from $15 to $30 per month, depending on coverage levels and your location. Moreover, having renters insurance can offer peace of mind that protects you financially and legally. For example, if someone is injured in your apartment, your policy can help cover their medical costs and legal fees. By debunking these myths, it becomes evident that investing in renters insurance is not only a prudent decision but also a vital safeguard for tenants.