Blitz News Digest

Stay updated with the latest trends and insights.

Why Your Auto Insurance Bill is Getting a Discount Hangover

Is your auto insurance discount fading? Discover why your premiums are creeping up and how to reclaim your savings!

Understanding the Factors Behind Your Auto Insurance Discount Hangover

When it comes to auto insurance discounts, many drivers may experience a sudden drop in their premiums after an initial period of savings, often referred to as a discount hangover. This phenomenon can be attributed to various factors, including changing risk profiles and policy renewals. For instance, insurance companies regularly reassess the risk associated with each driver based on claims history, credit score, and driving record. If your circumstances change—whether it’s getting into an accident or accruing points on your license—these factors can lead to a reevaluation of the discounts you initially received.

Additionally, insurance companies often introduce promotional discounts that have a limited time frame. As these promotions expire, the discounts that once helped lower your premium may vanish, leading to a sudden increase in your payment. Furthermore, it’s essential to consider the annual review process. As your insurance policy nears renewal, the lack of a recent discount application or the expiration of loyalty discounts can cause premiums to spike unexpectedly. Keeping track of these factors can help you prepare for potential changes and understand the reasons behind your discount hangover.

Is Your Auto Insurance Discount Just a Temporary Relief?

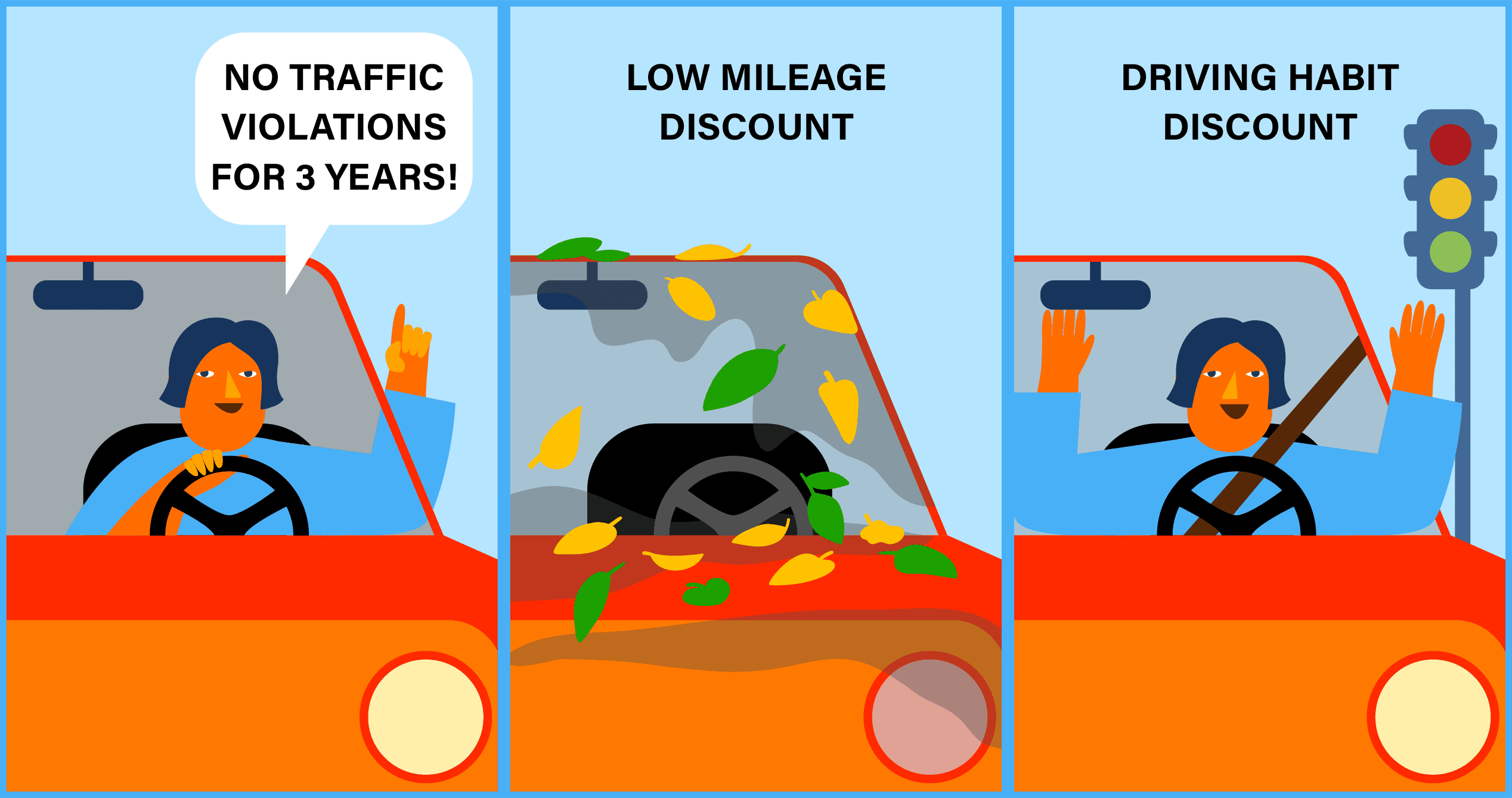

When you receive an auto insurance discount, it can feel like a significant financial relief, but it's essential to evaluate whether this savings is merely a temporary fix. Discounts may arise from various factors, such as safe driving records or bundling policies, but understanding the longevity of these discounts is crucial. Often, such promotions are time-limited, requiring drivers to remain vigilant about their driving habits and policy renewals to retain these financial benefits.

Additionally, even if you've secured an auto insurance discount, it's vital to regularly compare your rates with other providers. Insurance companies frequently adjust their pricing structures, and what appears to be a good deal today may not be favorable tomorrow. To ensure you're not left in a tough spot once the discount disappears, consider evaluating your coverage options and potential new discounts periodically. The best way to maintain financial stability in auto insurance is through proactive management and awareness of the policy landscape.

How to Navigate Through Auto Insurance Discounts and Avoid Future Surprises

Navigating through auto insurance discounts can be daunting, especially with the multitude of options available. Each insurance provider offers a variety of discounts, often based on factors such as your driving history, vehicle safety features, and even your occupation. To maximize your savings, it's crucial to compare multiple insurance quotes and ask specific questions about available discounts during your consultations. For instance, some insurers provide discounts for bundling policies, good student grades, or completing defensive driving courses. Making a checklist of possible discounts can help ensure you don’t miss out on potential savings.

To avoid future surprises when it comes to your auto insurance, it's important to read the fine print and understand the conditions attached to each discount. For example, some discounts may only apply for the first year or be contingent upon maintaining certain criteria, such as a clean driving record. Additionally, be cautious of policy changes that could affect your discounts over time. Regularly reviewing your policy and staying informed about changes in the insurance market can help you stay proactive, ensuring that you continue to benefit from the best auto insurance discounts without unexpected spikes in your premiums.