Blitz News Digest

Stay updated with the latest trends and insights.

Whole Life Insurance: A Safety Net You Didn't Know You Needed

Discover the hidden benefits of whole life insurance and why it might be the safety net you never knew you needed! Explore now!

What is Whole Life Insurance and How Does It Work?

Whole life insurance is a type of permanent life insurance that provides coverage for the insured individual's entire lifetime, as long as premiums are paid. This insurance product combines a death benefit with a cash value component that grows over time. For many, it serves as a financial safety net, ensuring that loved ones are financially protected in the event of the policyholder's death. The premiums are typically consistent and predictable, making it easier for policyholders to budget for their insurance expenses.

One of the key features of whole life insurance is the cash value accumulation. This cash value grows at a guaranteed rate and can be borrowed against or withdrawn during the policyholder's lifetime. However, it’s important to note that any loans or withdrawals will reduce the death benefit. As such, using the cash value should be approached thoughtfully. In summary, whole life insurance not only offers lifelong protection but also serves as a potential savings and investment vehicle, making it a versatile choice for many individuals seeking long-term financial security.

5 Key Benefits of Whole Life Insurance You Should Know

Whole life insurance offers a unique combination of benefits that can provide financial security throughout your life. One of the key advantages is the guaranteed cash value accumulation. Unlike term life insurance, which expires without value, whole life policies build cash value over time, allowing policyholders to borrow against it or even withdraw funds as needed. This feature not only acts as a savings component but also provides a financial cushion in emergencies.

Another significant benefit is the predictable premiums. Once you purchase a whole life insurance policy, your premium payments remain consistent throughout your life, regardless of changes in your health or age. This predictability makes it easier to budget for insurance expenses. Additionally, whole life policies often come with a death benefit that can help your beneficiaries cover expenses such as funeral costs, debts, and other financial needs, ensuring peace of mind for both you and your loved ones.

Is Whole Life Insurance Worth the Investment for Your Family?

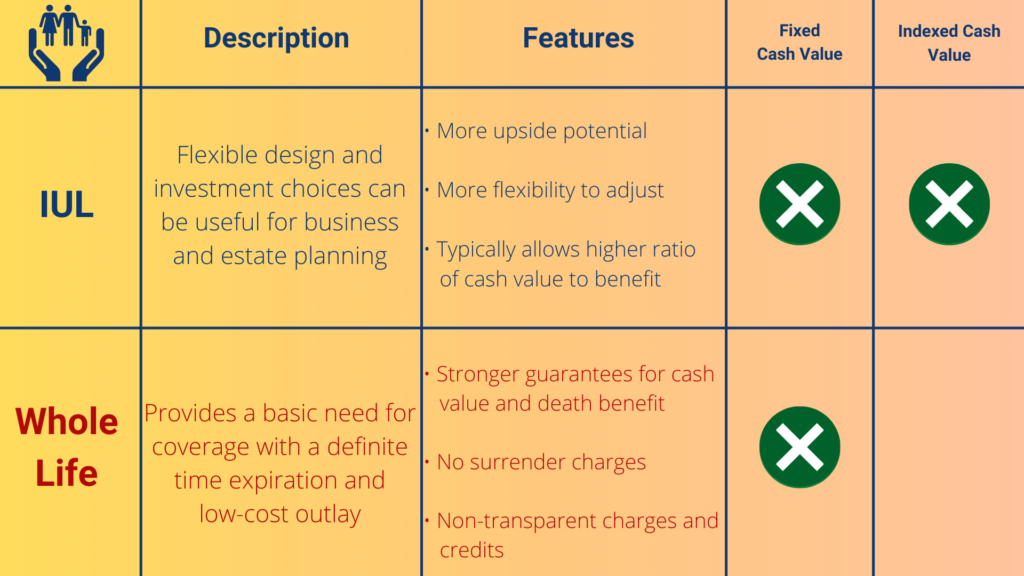

When considering whether whole life insurance is worth the investment for your family, it's essential to understand its unique features. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifelong protection and builds cash value over time. This cash value can serve as a financial asset for your family, which can be accessed through loans or withdrawals. However, it's important to note that the premiums for whole life insurance are generally higher than those for term policies, making it crucial to assess your family's long-term financial goals before committing to this investment.

Furthermore, the benefits of whole life insurance go beyond just providing a death benefit. For families looking for stability and peace of mind, this type of insurance can act as a savings vehicle, allowing your money to grow on a tax-deferred basis. Additionally, the guaranteed death benefit ensures that your loved ones will have financial support in the event of your passing. Ultimately, determining if whole life insurance is worth the investment for your family involves a careful evaluation of your financial situation and your family's needs. Consider consulting with a financial advisor to make an informed decision tailored to your unique circumstances.