Blitz News Digest

Stay updated with the latest trends and insights.

Whole Life Insurance: A Policy Worth Keeping in Your Back Pocket

Discover why whole life insurance is a smart financial backup! Unlock its benefits and secure your future today!

Understanding Whole Life Insurance: Key Benefits and Features

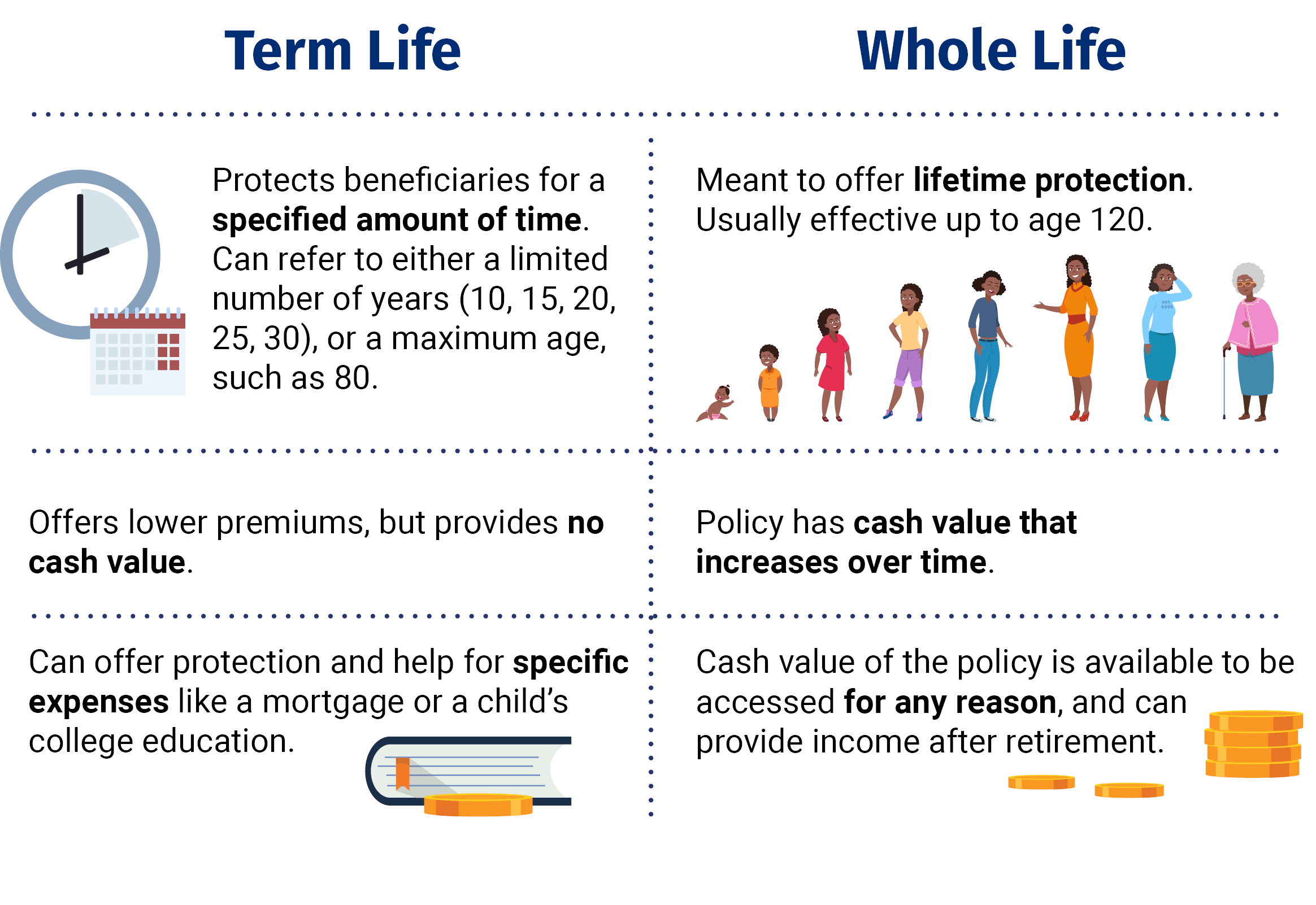

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's lifetime, as long as premiums are paid. One of its key features is the cash value component, which grows over time on a tax-deferred basis. This cash value can be borrowed against or withdrawn, offering policyholders a financial resource during their lifetime. Additionally, whole life policies typically come with a guaranteed death benefit, meaning that beneficiaries will receive a predetermined amount upon the policyholder's death, providing peace of mind and financial security for loved ones.

Among the several benefits of whole life insurance, the predictability of premiums and the reliability of growth are standout features. Unlike term life insurance, which only covers a specific period, whole life insurance offers long-term coverage and stable premium payments. This makes it easier for individuals to budget for insurance costs. Moreover, whole life insurance can serve as a powerful tool for estate planning, as the death benefit can help cover estate taxes and ensure that assets are passed down to heirs intact. By understanding these key benefits and features, consumers can make informed decisions about their life insurance needs.

Is Whole Life Insurance Right for You? Evaluating Your Financial Needs

When considering whether whole life insurance is right for you, it's essential to evaluate your financial needs and long-term goals. Whole life insurance offers a level of certainty due to its guaranteed death benefit and cash value accumulation, making it an attractive option for those looking for a lifelong financial safety net. However, it comes with higher premiums compared to term life insurance. Assess your current financial obligations, such as mortgage payments, children’s education, and retirement savings, to determine if investing in a policy that provides coverage for your entire life aligns with your overall financial strategy.

To help guide your decision, consider these key factors:

- Age: Younger individuals may benefit more from whole life insurance because the cost of premiums is lower when you are younger and healthier.

- Financial Goals: If you are seeking a savings component and want a reliable investment, whole life can serve dual purposes.

- Cash Flow: Analyze your budget to ensure you can comfortably afford the higher premium without sacrificing other financial priorities.

Ultimately, understanding your unique financial situation and how whole life insurance fits into your broader financial plan is crucial before making a commitment.

5 Common Misconceptions About Whole Life Insurance Debunked

Whole life insurance is often surrounded by myths and misconceptions that can lead to misunderstandings about its benefits. One common misconception is that whole life insurance is only for the wealthy. In reality, it can be a prudent choice for anyone looking to provide financial security for their loved ones. Many people believe that whole life insurance is solely a savings plan, but it actually serves as both a protection policy and an investment vehicle, potentially providing cash value that can grow over time.

Another prevalent myth is that whole life insurance is not flexible. Contrary to this belief, many policies offer options that allow policyholders to adjust their premiums and death benefits as their financial circumstances change. Additionally, some individuals think that whole life insurance is too expensive compared to term insurance. While it's true that premiums can be higher, the lifelong coverage and cash accumulation can make it a more cost-effective choice in the long run for those who are committed to maintaining the policy until maturity. Understanding these points can help demystify the value of whole life insurance.