Blitz News Digest

Stay updated with the latest trends and insights.

When Life Throws a Curveball: Why Disability Insurance is Your Safety Net

Discover how disability insurance can be your financial lifeline when life takes unexpected turns. Don't get caught unprepared!

Understanding Disability Insurance: How It Protects You When Life Gets Tough

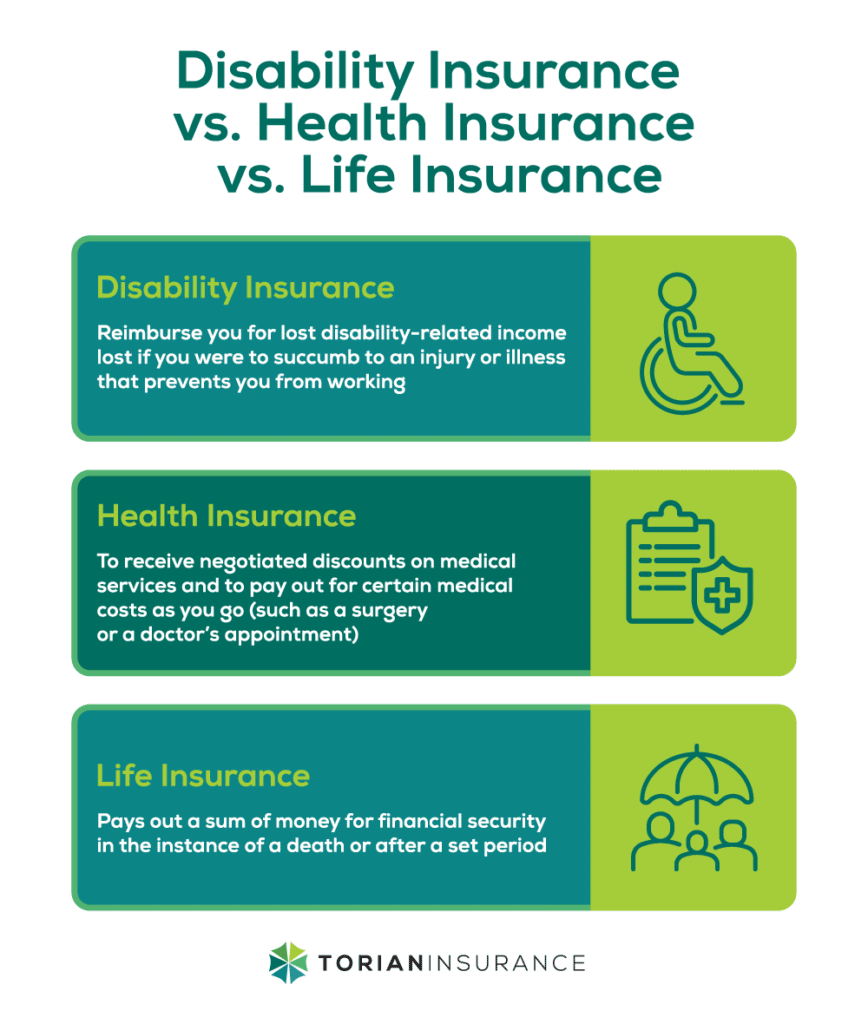

Understanding Disability Insurance is crucial for anyone looking to secure their financial future against unforeseen challenges. This type of insurance provides income replacement if you become unable to work due to a disability caused by an illness or injury. With the rising costs of living and uncertainties in health, having disability insurance ensures that you can maintain your quality of life, cover essential expenses, and focus on recovery without the added stress of financial instability.

In the face of adversity, disability insurance acts as a safety net, shielding you and your family from potential hardships. It typically offers a percentage of your income, which can help pay for necessities such as

- Mortgage or rent

- Utilities

- Medical bills

- Daily living expenses

Top 5 Reasons Why Disability Insurance is Essential for Financial Security

Disability insurance serves as a vital financial buffer that protects you and your family from unexpected events that hinder your ability to work. First and foremost, it provides a reliable source of income when you become unable to perform your job due to illness or injury. Without this safety net, you may struggle to meet essential expenses like mortgage payments, groceries, and medical bills, jeopardizing your financial stability. Statistics show that over 25% of today’s 20-year-olds will become disabled before they retire, making the need for disability coverage more pressing than ever.

Secondly, unlike other forms of insurance, disability insurance not only covers partial income loss but can also replace up to 60-70% of your monthly earnings, helping maintain your standard of living. In addition, it can be tailored to fit your specific needs, providing options for short-term and long-term coverage. Finally, having disability insurance can significantly reduce stress during recovery, allowing you to focus on your health and wellbeing instead of worrying about finances. In essence, investing in disability insurance is a crucial step toward ensuring your long-term financial security.

Is Your Safety Net Strong Enough? Key Questions to Ask About Disability Insurance

When considering your financial security, one crucial area to evaluate is your disability insurance. Is your safety net strong enough? This question encourages you to assess whether your current coverage can adequately support you in the event of an unexpected disability. To begin, ask yourself: What percentage of my income will the policy cover? Understanding the financial implications of a disability is vital; most policies offer between 50-70% of your income. Furthermore, consider the length of time benefits will be paid out if you suffer from a long-term disability. Can you sustain your lifestyle during that period?

Another key question to contemplate is: What are the definitions and exclusions in my plan? Not all disability insurance policies are created equal, and the terms of your coverage can greatly impact your safety net. For example, some plans might only cover disabilities arising from accidents while excluding illnesses. Assess whether your policy offers own occupation coverage, which protects your ability to work in your specific profession compared to any occupation, which could limit your benefits. By answering these critical questions, you can better determine if your disability insurance truly offers the protection you need.