Blitz News Digest

Stay updated with the latest trends and insights.

Term Life Insurance: Because Even Your Policy Should Have a Backup Plan

Discover why term life insurance is your safety net! Learn how a backup plan can protect your loved ones. Click to find out more!

Understanding the Basics: What is Term Life Insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from 10 to 30 years. During this term, if the insured person passes away, the beneficiaries receive a death benefit. This insurance is designed to offer financial protection for a temporary period, making it an ideal choice for individuals who want to secure their family’s financial future without the high premiums associated with permanent life insurance. The simplicity and affordability of term life insurance make it a popular option, especially for young families and individuals with significant financial responsibilities.

One of the defining features of term life insurance is that it does not accumulate cash value, meaning policyholders only receive the death benefit if they pass away within the agreed term. If the term expires and the insured is still alive, the policy simply ends, and no payout is made. This can lead to a sense of urgency for the insured to reassess their life insurance needs as they reach the end of their term. To navigate this, individuals should consider factors such as changes in income, family circumstances, and overall financial goals to determine whether to renew their policy, convert to a permanent one, or seek alternative solutions for long-term financial security.

5 Key Benefits of Term Life Insurance You Should Know

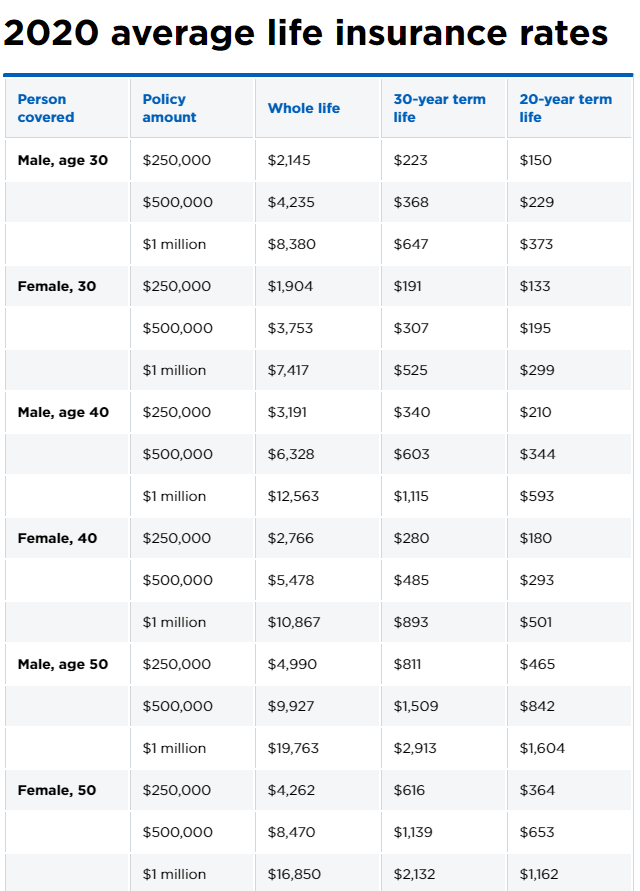

Term life insurance is a popular choice among individuals seeking affordable coverage for a specific period. One of the key benefits is its cost-effectiveness. Compared to permanent life insurance policies, term life offers lower monthly premiums, making it accessible for young families or individuals on a budget. Additionally, with customizable terms generally ranging from 10 to 30 years, policyholders can match their coverage to significant life events, ensuring financial protection during crucial periods.

Another advantage is the simplicity and clarity of coverage. Unlike more complex insurance options, term life insurance is straightforward. Policyholders are typically covered for the duration of the term, with a guaranteed payout to beneficiaries if death occurs within that period. This clarity helps individuals make informed decisions about their financial planning, ensuring that loved ones are protected. Moreover, the peace of mind it provides knowing that one’s family will be financially secure can be invaluable, highlighting why many consider it a vital component of their overall financial strategy.

Is Term Life Insurance Right for You? Common Questions Answered

If you're considering whether term life insurance is right for you, it's essential to evaluate your individual needs and circumstances. Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. This type of policy is often more affordable than whole life insurance and can be an excellent option for those seeking to protect their family's financial future during critical years, such as while raising children or paying off a mortgage.

Common questions arise when deciding on term life insurance policies. Here are a few to consider:

- How much coverage do I need? Assess your current financial obligations and future goals to determine an adequate coverage amount.

- What is the best term length for me? Choose a term that aligns with your long-term financial plans, such as until your children reach adulthood or your debts are paid off.

Understanding these factors can help you make an informed decision about whether term life insurance is the right fit for your financial strategy.