Blitz News Digest

Stay updated with the latest trends and insights.

Life Insurance: The Safety Net You Didn't Know You Needed

Discover why life insurance is the safety net you never knew you needed. Secure your family's future today!

Understanding Life Insurance: Key Benefits You Shouldn't Overlook

Understanding life insurance is crucial for anyone looking to secure their family’s financial future. It serves as a form of protection that can provide peace of mind in uncertain times. The primary benefit of life insurance is to ensure that your loved ones are financially supported in the event of your untimely death. This financial support can cover essential expenses such as mortgage payments, children's education, and daily living costs. Additionally, many life insurance policies can accumulate cash value over time, which can be used as an investment tool or emergency fund.

Another significant advantage of life insurance is its potential for tax benefits. The death benefit paid out to beneficiaries is typically tax-free, allowing your loved ones to receive the full amount of the policy without worrying about tax liabilities. Moreover, some life insurance policies offer options for riders that enhance coverage, such as critical illness or disability riders that provide additional financial support in case of severe health issues. Understanding these key benefits can help you make informed decisions about your financial planning and ensure that you don’t overlook essential protections for your loved ones.

Is Life Insurance the Ultimate Financial Safety Net for Your Family?

When considering financial stability, life insurance often emerges as a crucial component in safeguarding your family's future. It acts as a financial safety net that provides a considerable sum of money in the event of your untimely passing. This financial benefit can help cover essential expenses such as mortgage payments, educational costs for children, and daily living expenses that may otherwise burden your loved ones. Despite the emotional aspects surrounding discussions of mortality, it is vital to view life insurance through a practical lens, ensuring your family is protected from unforeseen financial hardships.

Moreover, life insurance offers peace of mind, allowing you to focus on the present without the constant worry of what could happen tomorrow. Many people underestimate the impact of losing a primary income earner and how quickly savings can deplete in such circumstances. By investing in a comprehensive life insurance policy, you are not merely purchasing a policy; you are taking a proactive step towards financial security. As you weigh your options, consider that life insurance may very well be the ultimate protective measure that provides ongoing support for your family in times of crisis.

Life Insurance Myths Debunked: What You Really Need to Know

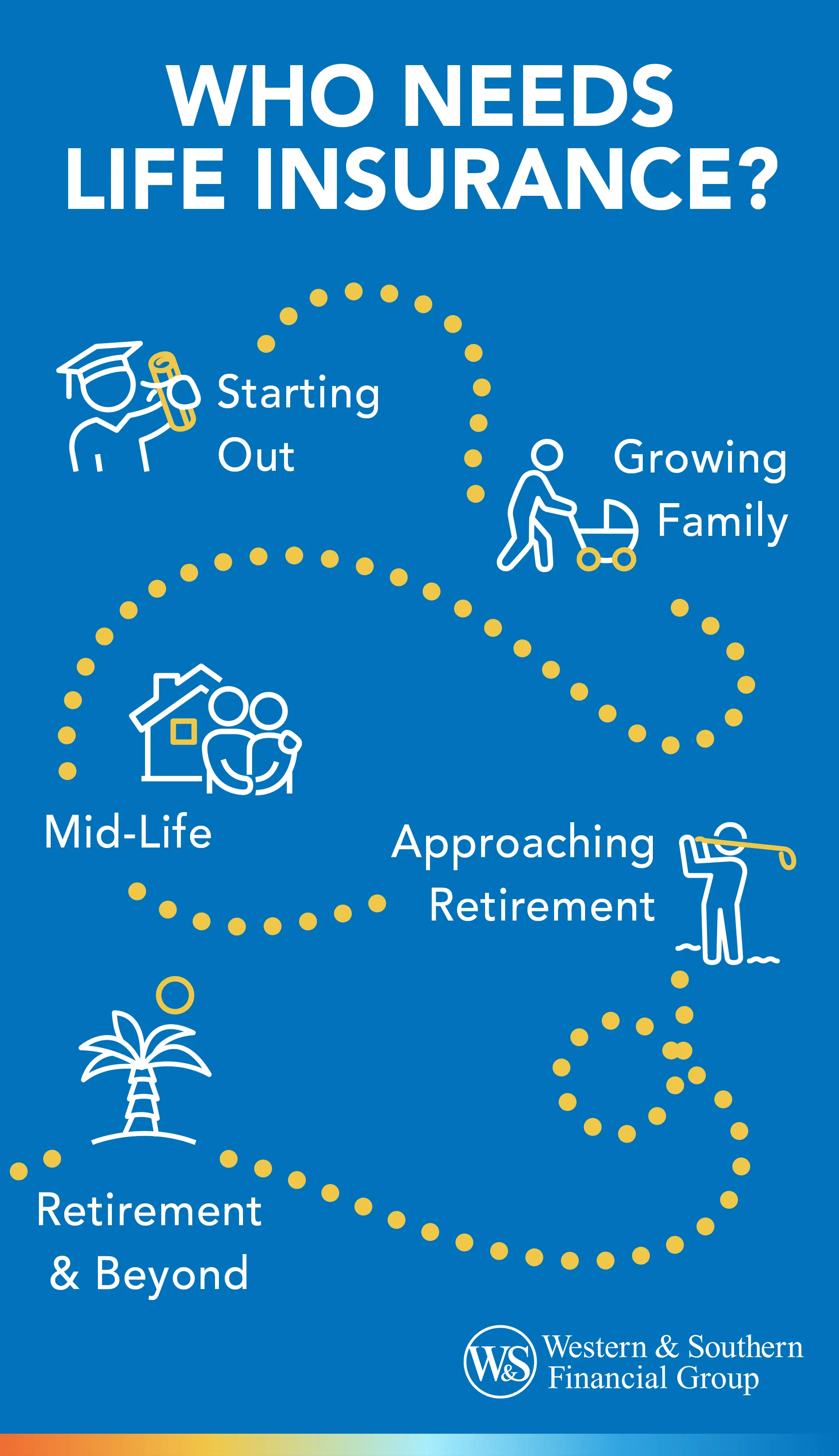

One of the most common myths about life insurance is that it is only necessary for older individuals or those with families. In reality, life insurance can be a crucial financial tool for anyone, regardless of age or marital status. Young professionals, especially those with student loans or dependent parents, may find that a life insurance policy offers essential protection and peace of mind. Moreover, purchasing life insurance at a younger age often results in lower premiums, making it a financially savvy decision.

Another prevalent misconception is that life insurance is too expensive for the average person. While it's true that costs can vary based on age, health, and policy type, many affordable options are available. In fact, term life insurance policies can provide significant coverage for relatively low monthly payments. It's important for individuals to assess their financial situation and explore various policies to find a plan that fits their budget and provides adequate protection for their loved ones.