Blitz News Digest

Stay updated with the latest trends and insights.

Cheap Insurance Shenanigans: How to Save Without the Stress

Unlock stress-free savings on insurance! Discover clever tips and tricks to cut costs without sacrificing coverage. Dive into the savings today!

Top 5 Tips for Finding Affordable Insurance Without the Headache

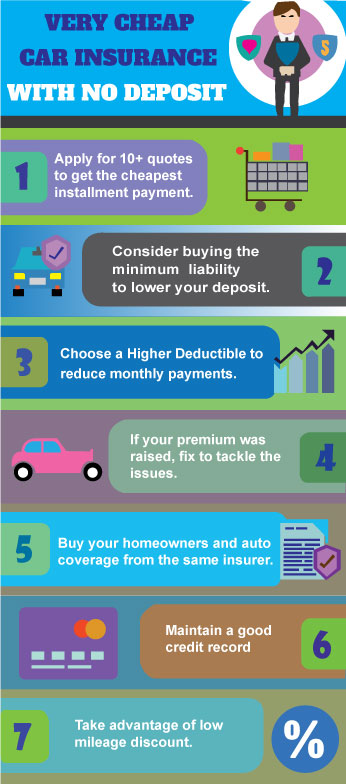

Finding affordable insurance can often feel overwhelming, but with the right approach, you can simplify the process. Start by researching multiple providers to compare coverage options and premiums. Utilize online tools and comparison sites to obtain quotes from various insurers. This helps you avoid settling for the first offer you find and gives you a better idea of what's available. Additionally, consider reaching out to insurance agents who can provide personalized assistance and may have access to exclusive discounts.

Next, take advantage of bundling options to maximize your savings. Many insurance companies offer discounts if you purchase multiple types of coverage, such as home and auto. Furthermore, be sure to review your deductibles and coverage limits. Adjusting these can lead to significant savings, but it’s crucial to ensure you’re not sacrificing essential protection. Finally, don't hesitate to shop around annually to ensure you’re still getting the best rate available.

Is Cheap Insurance Worth the Risk? What You Need to Know

When considering cheap insurance, it’s crucial to weigh the potential risks against the financial savings. While lower premiums may seem appealing at first glance, they can often come with trade-offs in coverage quality and customer service. At times, these policies may not provide adequate support in critical situations, leaving policyholders exposed to significant out-of-pocket expenses. It’s essential to thoroughly read the terms and conditions to understand what is and isn’t covered.

Additionally, cheap insurance can sometimes result in less reliable claims processing. In a situation where you need to file a claim, you might find that the low-cost option is not as responsive or supportive as a more reputable provider. To ensure that you are making a sound decision, consider asking yourself these questions:

- What is the coverage limit?

- Are there any exclusions that could impact me?

- How do customer reviews reflect the company’s claims process?

The Ultimate Guide to Saving on Insurance: Strategies that Work

Insurance can often feel like a necessary evil, draining your budget without much tangible return. However, understanding strategies to save on insurance can make a significant difference in your financial health. Start by reviewing your existing policies; many providers offer discounts for bundling multiple types of coverage, such as home, auto, and life insurance. Additionally, consider adjusting your deductibles. Increasing your deductible can lower your premium, but ensure that you have enough funds set aside to cover the higher out-of-pocket costs in case of a claim.

Another effective strategy is to regularly compare quotes from different insurers. Using online comparison tools can help you discover better deals without the hassle of contacting each company individually. Don't forget to evaluate your coverage needs annually. As your life circumstances change—such as buying a new home, getting married, or retiring—your insurance requirements may shift, potentially allowing for lower premiums. Implementing these strategies can lead to substantial savings and ensure you have the right coverage for your current lifestyle.