Blitz News Digest

Stay updated with the latest trends and insights.

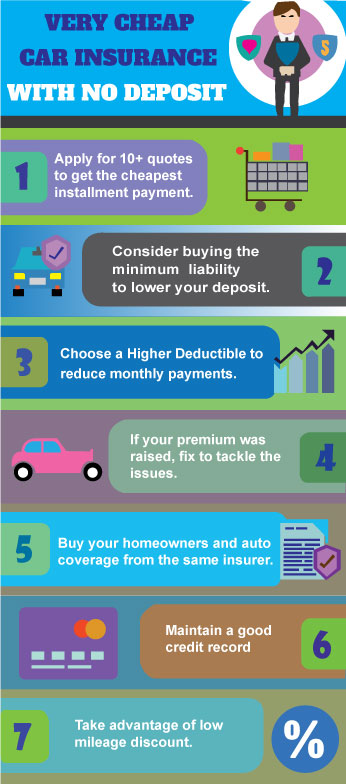

Insurance on a Budget: Saving Without Sacrifice

Unlock the secrets to affordable insurance! Discover smart strategies to save big without sacrificing coverage. Start saving today!

Top 5 Ways to Cut Insurance Costs Without Compromising Coverage

Finding ways to cut insurance costs can be a daunting task, especially when you're trying to maintain adequate coverage. However, there are effective strategies to reduce expenses without sacrificing the protection you need. Here are the top 5 ways to achieve this:

- Compare Quotes: One of the most effective ways to lower insurance premiums is to shop around and compare quotes from different providers. Websites and tools that aggregate multiple quotes can help you see which companies offer the best rates for the same coverage.

- Increase Your Deductible: By raising your deductible, you can significantly lower your monthly premium. Just be sure that you have the necessary funds set aside to cover the higher deductible in case of a claim!

- Bundle Insurance Policies: Many insurance companies offer substantial discounts for bundling multiple policies, such as home and auto insurance. This can lead to reduced costs while ensuring you have comprehensive coverage.

- Maintain a Good Credit Score: Your credit score can affect your insurance rates. By keeping an eye on your credit report and making timely payments, you can qualify for better rates over time.

- Review Your Coverage Regularly: As your life circumstances change, so should your insurance coverage. Regularly reviewing your policies can help identify areas where you might be over-insured or have unnecessary add-ons, resulting in lower costs.

Understanding Your Insurance Needs: Balancing Budget and Protection

Choosing the right insurance coverage can often feel overwhelming, but understanding your insurance needs is crucial for both financial security and peace of mind. To start, it's essential to assess what assets and liabilities you have. Consider creating a list of valuable items, such as your home, car, and personal belongings, as well as any potential risks that could affect your life. By evaluating these factors, you can better determine the level of protection required while keeping your budget in check.

Once you have a clearer picture of your insurance needs, it's time to explore available options. Start by obtaining quotes from multiple providers and comparing coverage plans. Don’t hesitate to ask questions about the fine print—what is covered and what isn’t can make a significant difference in your protection. Remember, it’s about finding a balance; you want enough coverage to safeguard against unforeseen events without straining your finances. As you navigate this process, prioritize your requirements so that you make informed decisions that align with your financial goals.

Can You Really Save on Insurance? Tips for Finding the Best Deals

When it comes to insurance, many people are left wondering, can you really save on insurance? The answer is yes, but it requires some strategic planning and research. One of the most effective ways to save money is to regularly compare quotes from different providers. Consider using online tools that allow you to input your information and quickly see a range of options. Additionally, bundling different types of insurance, such as auto and home, can often lead to significant discounts. Don't forget to review your policy annually to ensure you are not paying for coverage you no longer need.

Another tip for finding the best deals is to take advantage of available discounts. Many insurance companies offer discounts for safe driving, good credit scores, or even for being a member of certain organizations. It’s also worth asking your provider about any niche discounts that might apply to you. Remember, loyalty does not always lead to the best deals, so don’t hesitate to shop around and negotiate. By taking these steps, you can significantly cut your insurance costs and ensure you are getting the best value for your money.