Blitz News Digest

Stay updated with the latest trends and insights.

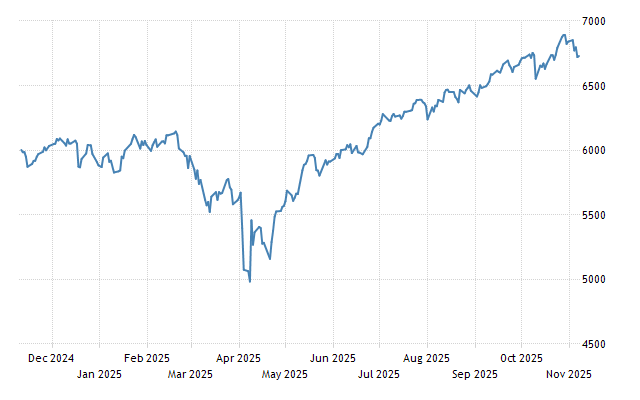

When Stocks Go Wild: A Rollercoaster Ride for Your Portfolio

Buckle up! Discover how wild stock market swings can transform your portfolio into a thrilling rollercoaster ride. Don’t miss the excitement!

Understanding Market Volatility: How to Navigate Stock Swings

Understanding market volatility is essential for investors seeking to navigate the unpredictable nature of stock swings. Market volatility refers to the degree of variation of trading prices over time, often driven by economic factors, investor sentiment, and global events. Recognizing these fluctuations can help investors make informed decisions, whether they are investing for the long-term or trading in the short-term. To effectively navigate stock swings, consider developing a sound investment strategy that includes diversification, setting clear goals, and remaining disciplined during turbulent times.

When facing market volatility, employing certain strategies can enhance your ability to manage risk. Here are a few approaches:

- Diversification: Spread your investments across different sectors to minimize the impact of downturns in any one area.

- Stay Informed: Keep abreast of market trends and news to anticipate potential swings.

- Establish Stop-Loss Orders: Limit potential losses by setting predetermined sell points.

Top Strategies for Managing Your Portfolio During Wild Market Fluctuations

In times of wild market fluctuations, it is crucial to have a well-defined strategy for managing your portfolio. One effective approach is to diversify your investments. By spreading your assets across various sectors, industries, and geographical regions, you can reduce the impact of volatility in any single area. Consider incorporating a mix of stocks, bonds, ETFs, and other asset classes into your portfolio. This will not only provide a buffer against downturns but also open up potential growth opportunities in unexpected places.

Another vital strategy is to maintain a disciplined approach to asset allocation. Review your portfolio regularly and adjust your holdings based on your risk tolerance and investment goals. During periods of significant market movement, it may be tempting to react impulsively; however, taking a step back and reassessing your long-term strategy can often lead to better outcomes. Additionally, employing techniques such as rebalancing and utilizing stop-loss orders can help minimize losses while maximizing growth potential in fluctuating markets.

What Causes Stocks to Skyrocket or Plummet: A Deep Dive into Market Dynamics

The stock market is a complex ecosystem influenced by a myriad of factors, each capable of causing stocks to skyrocket or plummet. At the heart of these dynamics lies the interplay between investor sentiment, economic indicators, and corporate performance. For instance, positive news such as better-than-expected earnings reports or favorable economic data can ignite investor enthusiasm, leading to a surge in stock prices. Conversely, adverse events—such as a sudden economic downturn or regulatory changes—can trigger panic selling, resulting in steep declines. Understanding these factors is crucial for investors looking to navigate the volatile landscape of the financial markets.

Another significant driver of stock price fluctuations is the role of market speculation. Investors often react not just to actual data, but to expectations and sentiments about future performance. This can lead to market bubbles, where stock prices are driven to unsustainable levels based on hype rather than fundamentals. When the reality fails to match the anticipation, a sharp correction can occur, causing stocks to plummet. Additionally, external factors such as geopolitical events, interest rate changes, and technological advancements can also significantly impact market dynamics, making it essential for investors to stay informed and adaptable in an ever-changing environment.