Blitz News Digest

Stay updated with the latest trends and insights.

Why Whole Life Insurance Is Like That One Unfinished Novel You Never Read

Discover why whole life insurance is the unfinished story in your financial journey. Dive in to unravel the mystery and potential today!

The Unwritten Story of Whole Life Insurance: What You're Missing

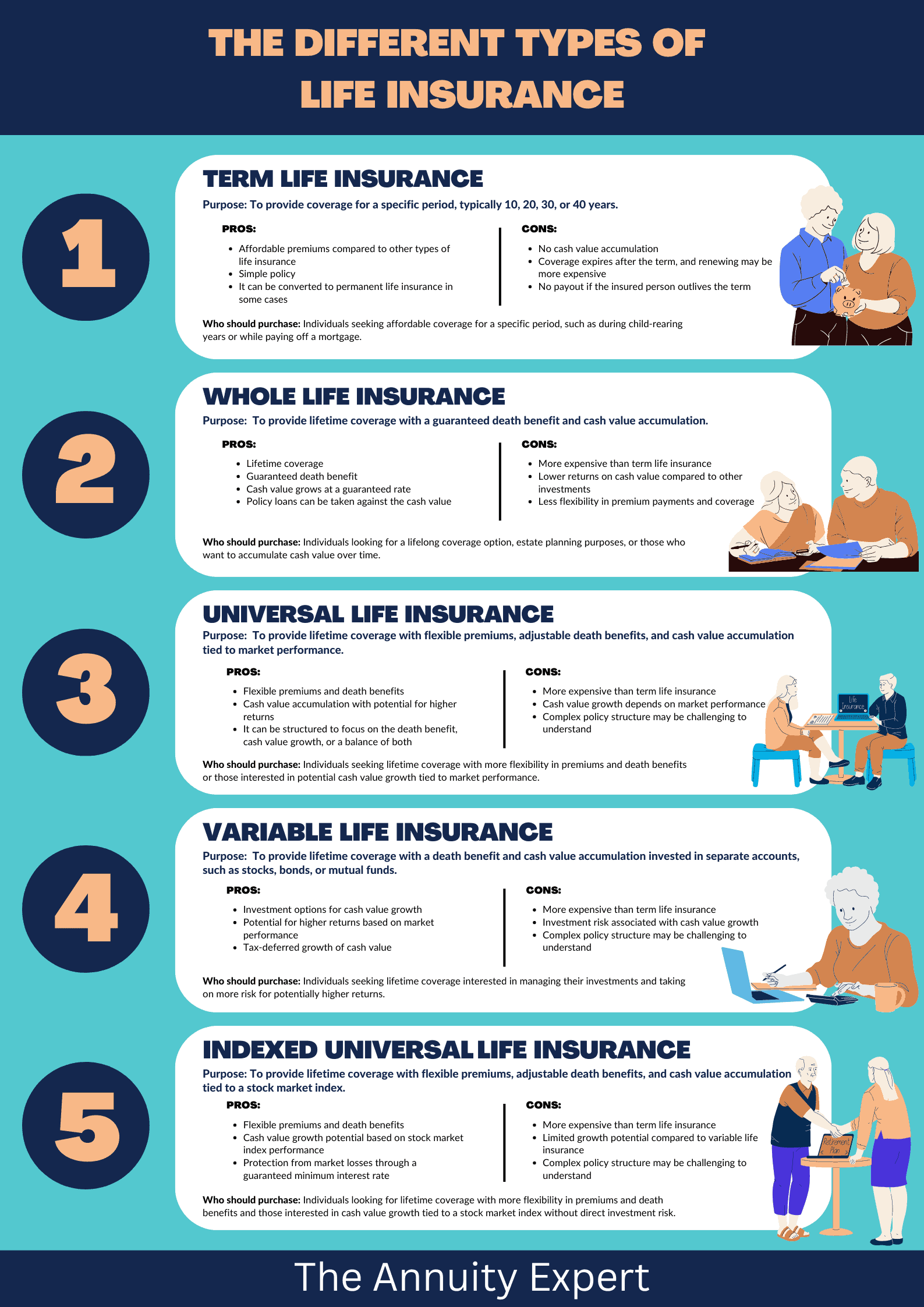

Whole life insurance is often viewed as just another financial tool, but it carries a rich unwritten story that many policyholders overlook. Most people are familiar with its basic premise: it provides lifelong coverage and includes a savings component that grows over time. However, what you're missing are the profound benefits that lie beneath the surface. For instance, did you know that whole life insurance can serve as a powerful asset class for wealth building? Its cash value can be accessed through loans or withdrawals, allowing policyholders to leverage it for major life events such as buying a home or funding education. Exploring these undisclosed benefits can change your perspective on how whole life insurance fits into your overall financial strategy.

Moreover, the unwritten story of whole life insurance extends to its role in legacy planning and tax efficiency. Unlike term insurance, which only pays out if the insured passes away during the policy term, whole life policies are designed to create a lasting financial legacy for your heirs. The death benefit is generally tax-free, ensuring that your loved ones receive the full value of your policy. Additionally, the cash value accumulation is tax-deferred, allowing your investment to grow without immediate tax implications. This dual advantage underscores the importance of incorporating whole life insurance into your long-term financial planning. Understanding these key aspects is essential for anyone looking to secure their family's future.

Why Whole Life Insurance Deserves a Second Look Like Your Favorite Unfinished Novel

Many people dismiss whole life insurance as an outdated financial product, often favoring term life insurance due to its lower premiums. However, just like your favorite unfinished novel, whole life insurance has layers of depth that are worth exploring. While the upfront cost might seem high, these policies accumulate cash value over time, providing a unique combination of protection and savings. This dual benefit is comparable to a multifaceted storyline where, in addition to life coverage, you gain the ability to borrow against the cash value or receive dividends, enhancing your financial strategy.

Moreover, the predictability of whole life insurance makes it a compelling choice for long-term financial planning. Unlike term policies that expire, whole life insurance provides a guaranteed death benefit and a level premium throughout your life. As you delve deeper into the narrative of your financial journey, you'll find that this insurance type can serve as a cornerstone in a broader wealth management strategy. By considering whole life insurance through a fresh lens, you may discover that what once seemed irrelevant is indeed a critical chapter in your financial story.

Is Whole Life Insurance the Hidden Gem in Your Financial Library?

When considering the various facets of personal finance, many individuals overlook whole life insurance as a powerful tool in their financial arsenal. Unlike term life insurance, which only provides coverage for a specified period, whole life insurance offers lifelong protection and accumulated cash value. This dual benefit allows policyholders not only to secure their family’s future but also to build a financial asset that grows over time. As a result, whole life insurance can serve as a foundational piece in your financial library, offering stability and peace of mind in an unpredictable world.

One of the hidden advantages of whole life insurance is its capacity for tax-deferred growth. The cash value component of the policy can be accessed through loans or withdrawals, often without incurring any tax liabilities. Additionally, the death benefit paid out to beneficiaries is typically tax-free. As such, whole life insurance can play a significant role in wealth transfer strategies and retirement planning. By including it in your financial toolbox, you not only secure a safety net for your loved ones but also enhance your financial flexibility and legacy planning.