Blitz News Digest

Stay updated with the latest trends and insights.

Whole Life Insurance: The Lifeline You Didn't Know You Needed

Discover why whole life insurance could be your ultimate financial safety net—it's more essential than you think!

Understanding Whole Life Insurance: How It Works and Benefits

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. Its key features include a guaranteed death benefit and a savings component known as cash value. Unlike term life insurance, which only covers a specific period, whole life insurance ensures that beneficiaries receive a payout regardless of when the insured passes away. This stability makes it a popular choice for individuals seeking long-term financial security for their loved ones.

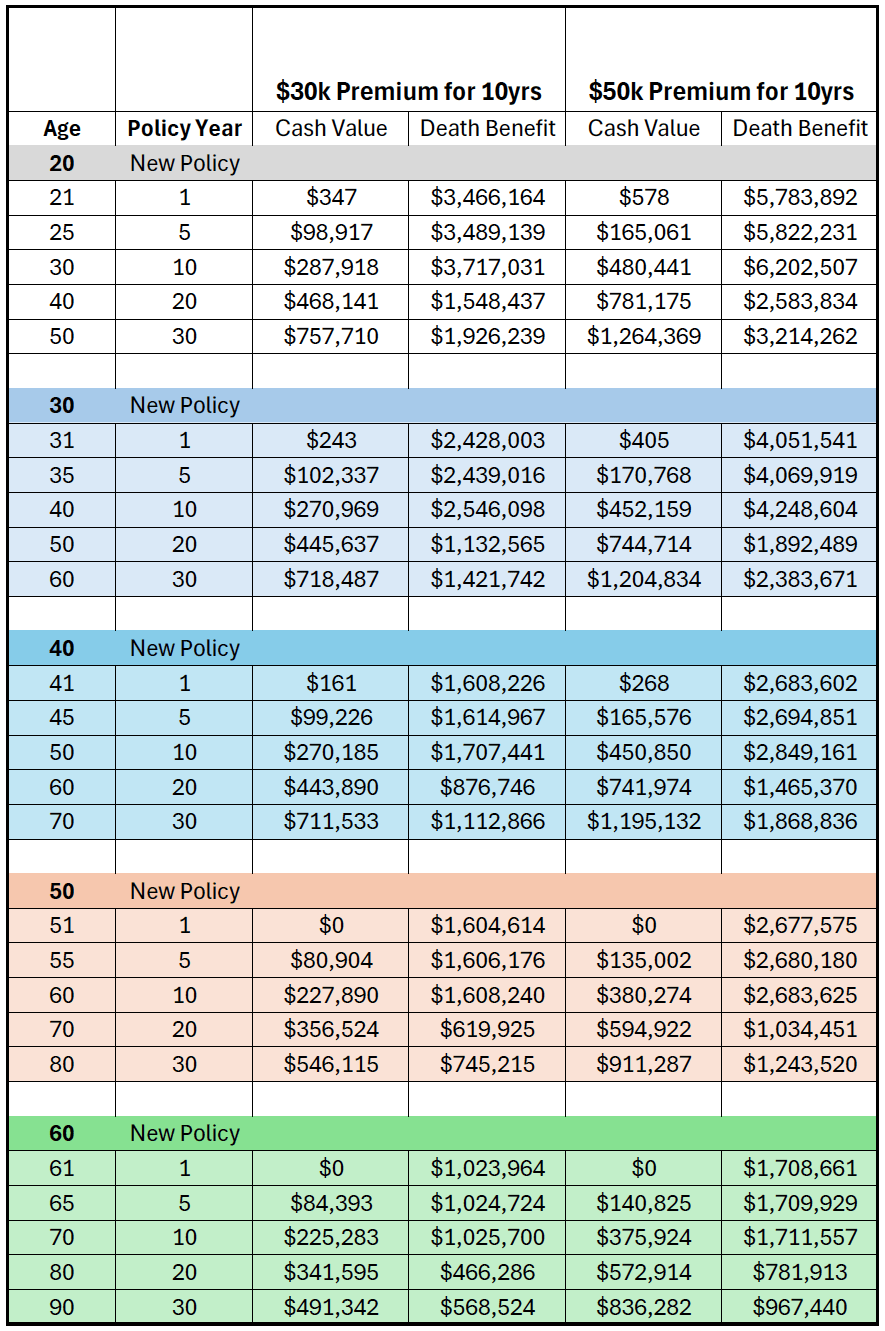

One of the significant benefits of whole life insurance is the accumulation of cash value over time, which grows at a guaranteed rate set by the insurance company. This cash value can be borrowed against or withdrawn to cover expenses like education, emergencies, or other significant financial needs. Additionally, whole life policies often come with fixed premiums that do not increase as the insured ages, making budgeting easier for policyholders. Overall, understanding how whole life insurance works and its benefits can help individuals make informed decisions about their financial future.

Top 5 Reasons Why Whole Life Insurance is Essential for Your Financial Plan

Whole life insurance is a crucial component of a well-rounded financial plan. One of the primary reasons for its importance is cash value accumulation. Unlike term life insurance, whole life policies build cash value over time, which can be borrowed against or withdrawn if needed. This feature not only provides a safety net in financial emergencies but also acts as a long-term savings vehicle, enhancing your overall financial stability.

Another compelling reason to consider whole life insurance is its ability to provide lifelong coverage. While term policies expire after a set number of years, whole life insurance guarantees protection for the entire lifetime of the insured, as long as premiums are paid. This means that your loved ones will always be financially protected, giving you peace of mind knowing that they will not face financial hardships in the event of your passing.

Is Whole Life Insurance Right for You? Key Questions to Consider

When considering whole life insurance, it's crucial to evaluate your unique financial situation and goals. Start by asking yourself key questions: Do you have dependents who rely on your income? How long do you need coverage, and what are your long-term financial objectives? Whole life insurance can provide not only a death benefit but also a cash value component that grows over time, which can be an attractive option for those looking to combine insurance with a savings strategy.

Another important aspect to consider is the cost. Whole life insurance typically has higher premiums compared to term life insurance. Ask yourself if you can comfortably afford these payments without compromising your overall financial health. Additionally, assess how the policy's features align with your long-term plans. If you're seeking stability and a guaranteed return, whole life insurance may be the right choice for you.