Blitz News Digest

Stay updated with the latest trends and insights.

Whole Life Insurance: The Gift That Keeps on Giving

Unlock the secret to financial security! Discover why whole life insurance is the ultimate gift for your loved ones and future!

Understanding Whole Life Insurance: Is It Right for You?

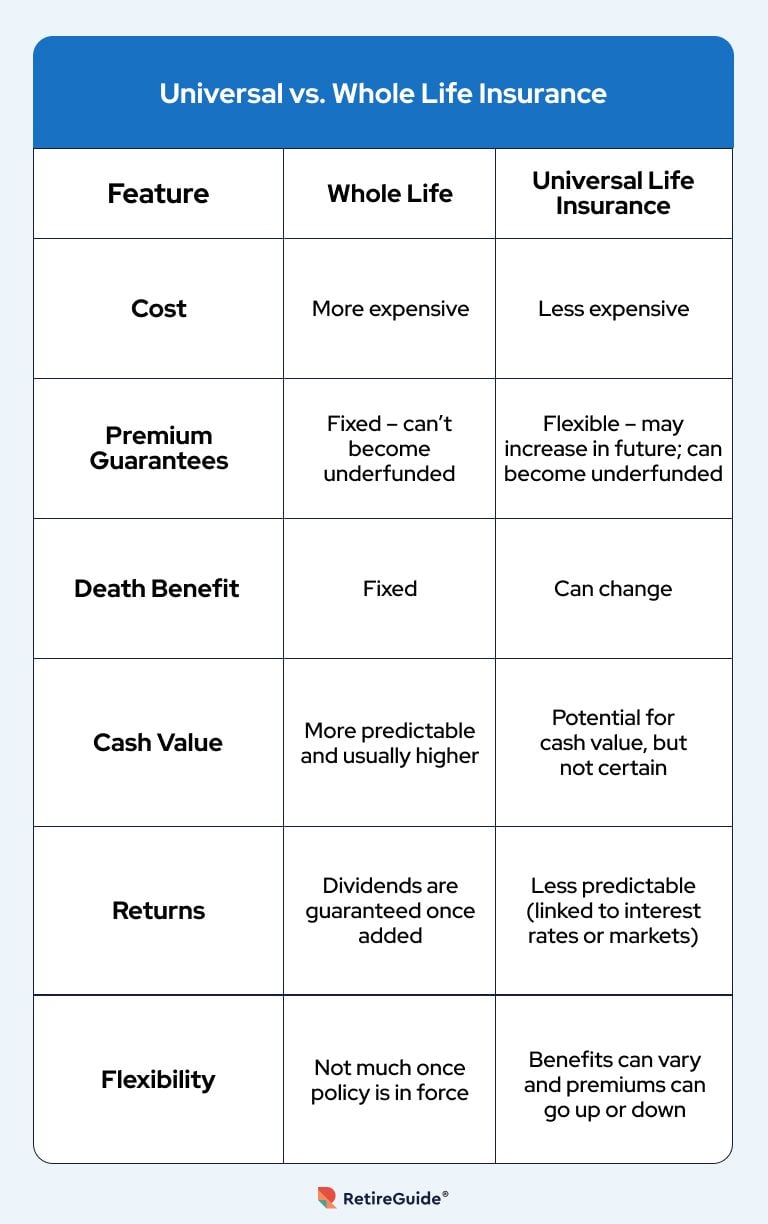

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. This financial product is designed not only to offer a death benefit to beneficiaries upon the policyholder's passing but also to accumulate cash value over time. As a result, it can be an appealing option for individuals looking to build a financial legacy. Understanding the intricate details of whole life insurance is essential in determining whether this type of policy aligns with your long-term financial goals.

When considering whole life insurance, it's important to weigh both the advantages and disadvantages. Some of the key benefits include guaranteed cash value accumulation, a fixed premium that does not increase with age, and the potential for dividends from the insurance company. However, it’s vital also to recognize the downsides, such as higher premium costs compared to term life insurance, which may not be feasible for everyone. To decide if whole life insurance is right for you, assess your financial situation, future goals, and the specific needs of your family.

The Benefits of Whole Life Insurance: More Than Just a Safety Net

Whole life insurance offers a multitude of benefits that extend far beyond just providing a safety net for your loved ones in the event of your passing. One of the most significant advantages is the cash value component that grows over time, allowing policyholders to build wealth while enjoying peace of mind. This cash value can be accessed through loans or withdrawals, which can be particularly useful in times of financial need or for funding major life events such as education or retirement. Additionally, the premiums are typically fixed, which means you can budget effectively without worrying about unexpected increases as you age.

Moreover, whole life insurance provides long-term financial security and can serve as an integral part of your estate planning strategy. Upon your passing, the death benefit can help cover estate taxes, ensuring that your heirs receive the full value of your estate without being burdened by financial obligations. Furthermore, the tax advantages associated with whole life policies, including tax-deferred growth of the cash value and tax-free death benefits, make it an attractive option for those looking to leave a legacy. In summary, investing in a whole life insurance policy not only protects your family but also contributes to your overall financial health and legacy planning.

Common Misconceptions About Whole Life Insurance: What You Need to Know

Whole life insurance is often surrounded by misconceptions that can lead potential policyholders to make uninformed decisions. One common myth is that whole life insurance is simply not worth the cost. While it's true that whole life policies come with higher premiums compared to term life insurance, it's important to remember that they offer lifelong coverage and accumulate cash value over time. This cash value can serve as a financial resource in the future, providing policyholders with several options such as loans or withdrawals.

Another prevalent misconception is that whole life insurance is only beneficial for the wealthy. In reality, whole life policies can be tailored to fit different budgets and financial goals. Many individuals believe that whole life insurance is too complex to understand, but with the right guidance, it can be a straightforward solution for long-term financial planning. Educating yourself about the different features and benefits is key to determining whether a whole life policy is the right choice for you.