Blitz News Digest

Stay updated with the latest trends and insights.

Term Life Insurance: Because Life is Unpredictable

Secure your loved ones' future with term life insurance—protect against the unpredictable and ensure peace of mind today!

Understanding Term Life Insurance: Key Benefits and Features

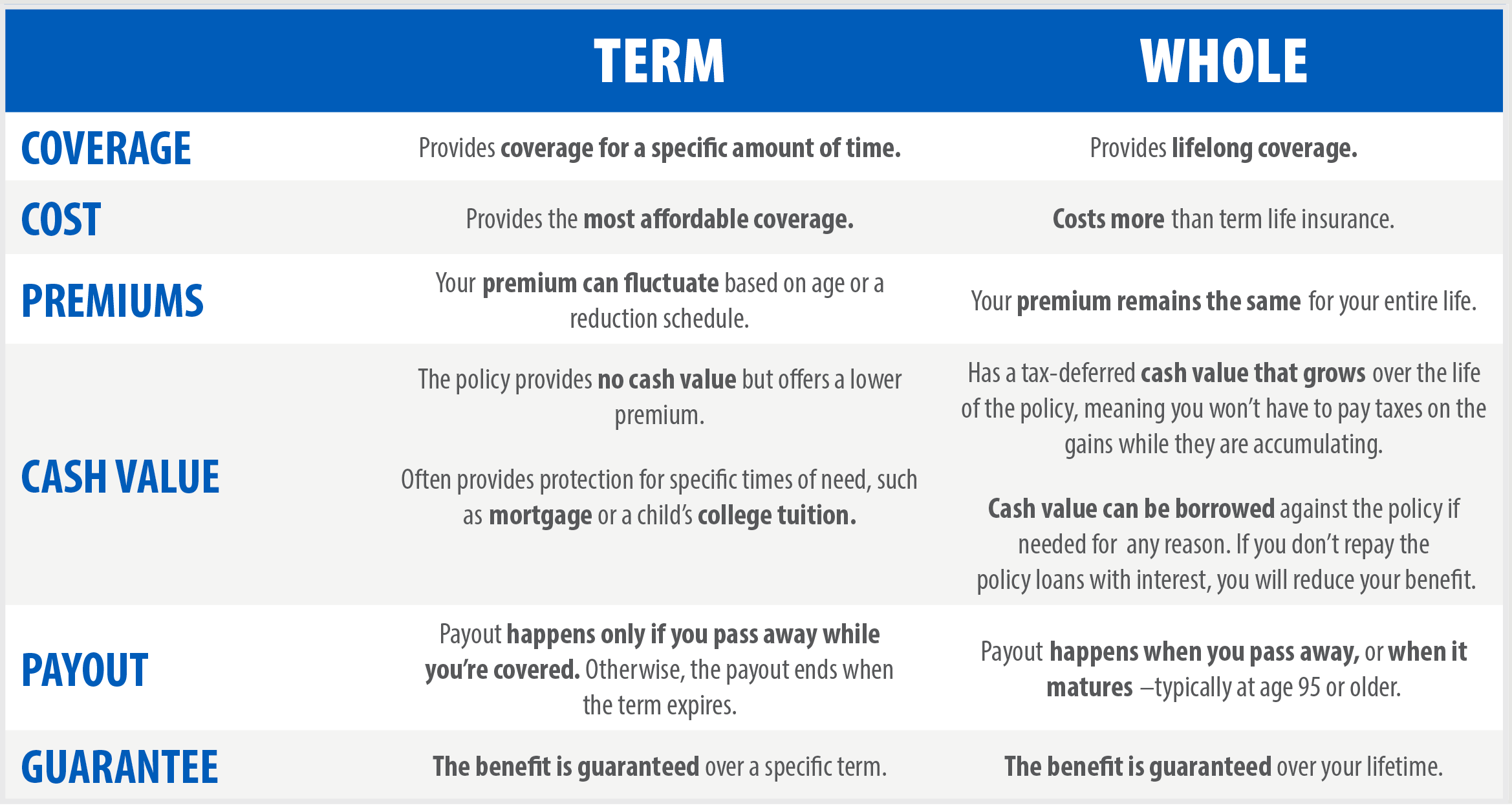

Term life insurance is a popular choice for individuals seeking affordable coverage for a specified period, typically ranging from 10 to 30 years. Unlike whole life insurance, which offers lifelong protection and builds cash value, term life insurance is designed only to provide a death benefit. This makes it a cost-effective option for those who want to ensure their loved ones are financially secure in the event of their untimely passing. The coverage can be tailored to fit specific needs, such as covering a mortgage or supporting children until they are financially independent.

One of the key benefits of term life insurance is its simplicity. Policyholders pay a set premium for the duration of the term, which can provide peace of mind knowing that their beneficiaries will receive a predetermined payout if the insured passes away during that period. Additionally, many insurers offer the option to convert a term policy to a permanent one, allowing for flexibility as financial needs evolve. Overall, understanding the features and advantages of term life insurance can help individuals make informed decisions about their financial planning and protection strategies.

Is Term Life Insurance Right for You? Assessing Your Needs

When considering whether term life insurance is right for you, it’s essential to assess your specific financial situation and personal goals. Term life insurance is typically designed to provide coverage for a set period, usually ranging from 10 to 30 years. This type of insurance can be particularly beneficial for individuals who have temporary financial responsibilities, such as raising children or paying off a mortgage. To determine your needs, consider the following factors:

- Your current financial obligations

- Dependents and their future needs

- Current debts and liabilities

Another crucial aspect of evaluating whether term life insurance is suitable for you is understanding the cost versus the benefits it provides. Premiums for term life insurance are generally lower than those for whole life options since they do not build cash value over time. This can make them an attractive choice, especially for young families or individuals looking for affordable coverage. Additionally, keeping an eye on your health and lifestyle choices can influence your premiums and insurability. Overall, carefully weighing these considerations will help you make an informed decision about whether term life insurance aligns with your long-term financial strategy.

FAQs About Term Life Insurance: What You Need to Know

Term life insurance is a type of life insurance that provides coverage for a specific period, commonly ranging from 10 to 30 years. Many people opt for this type of policy because it is generally more affordable than whole life insurance. If you pass away during the term of the policy, your beneficiaries will receive a death benefit, which can help cover living expenses, debts, or any other financial obligations. One of the most frequently asked questions is, 'What happens if I outlive my term life insurance policy?' In this case, you typically do not receive any payout, and the policy expires. However, some policies offer options for renewal or conversion to a permanent policy.

Another common FAQ is, 'Can I customize my term life insurance policy?' Yes, most providers allow you to tailor your coverage to suit your needs. You can adjust the coverage amount, term length, and even add riders for additional benefits, such as critical illness coverage or accidental death coverage. It's crucial to assess your financial situation and future needs carefully before choosing a policy to ensure it aligns with your goals. This customization can make your term life insurance more effective in protecting your loved ones in the event of your untimely passing.