Blitz News Digest

Stay updated with the latest trends and insights.

Term Life Insurance: Here’s Why It’s the Safety Net You Never Knew You Needed

Discover the surprising benefits of term life insurance and how it can protect your loved ones when they need it most!

Understanding Term Life Insurance: Key Benefits Explained

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from 10 to 30 years. One of its key benefits is affordability; since term life insurance only pays out if the insured person passes away within the term, it tends to have lower premiums compared to whole life insurance. This makes it an attractive option for families looking to ensure financial security for their loved ones without breaking the bank. Additionally, many policies offer the possibility to convert to permanent coverage as life circumstances change, making it a flexible choice for those planning for the future.

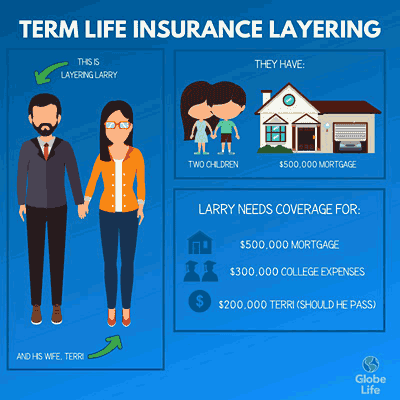

Another significant advantage of term life insurance is its straightforward structure. Policyholders can easily understand the coverage amount, duration, and the guarantee of payout, which provides peace of mind. Moreover, this type of insurance allows individuals to tailor their coverage amounts to meet specific needs, such as covering a mortgage or supporting children's education. Ultimately, having a clear purpose for the coverage can help families make informed decisions, ensuring that they choose the right policy that offers the best protection for their financial future.

Is Term Life Insurance Right for You? Top Questions Answered

Choosing the right insurance can be a daunting task, and understanding term life insurance is a crucial step in that process. Term life insurance is designed to provide coverage for a specific period, usually ranging from 10 to 30 years. This type of policy can be an affordable way to ensure your loved ones are financially protected in the event of your untimely death. When evaluating if term life insurance is right for you, consider factors such as your current financial obligations, family needs, and how long you require coverage. Here are some essential questions to reflect on:

- What financial responsibilities do you have?

- Do you have dependents relying on your income?

- What is the best coverage duration for your needs?

Another important aspect to consider is the affordability of term life insurance. Since it typically offers lower premiums compared to permanent policies, it can be an attractive option for those on a budget. However, it's vital to assess if the policy amount aligns with your family's future financial goals, such as mortgage payments, education expenses, and daily living costs. If you answer 'yes' to the questions above and find a term life insurance policy that fits your budget, then it might just be the right choice for you. Remember, it's always wise to consult with a financial advisor or insurance expert to navigate your options effectively.

The Financial Security of Term Life Insurance: Why It Matters

Term life insurance serves as a crucial component of financial planning, offering a safety net for families during unforeseen circumstances. Unlike whole life insurance, which can act as an investment vehicle, term life insurance strictly provides a death benefit for a specified period. This structure means that policyholders can secure significant coverage at a lower cost, making it an accessible option for many. In times of financial uncertainty, knowing that your loved ones will be protected by a lump-sum payout can alleviate stress and offer peace of mind.

Moreover, the financial security of term life insurance extends beyond just the payout. It plays a significant role in covering essential expenses, such as mortgage payments, college tuition, and everyday living costs. By ensuring that debts and obligations are met, term life insurance can help maintain a family's standard of living in the event of a tragedy. In addition, individuals who purchase term life insurance often benefit from lower premiums compared to other types of insurance, allowing them to allocate more of their budget to savings and investments, enhancing their overall financial stability.