Blitz News Digest

Stay updated with the latest trends and insights.

Snagging Sweet Deals: How to Cut Your Auto Insurance Costs

Unlock huge savings on auto insurance! Discover top tips to cut costs and snag sweet deals today. Your wallet will thank you!

10 Easy Tips to Lower Your Auto Insurance Premiums

Lowering your auto insurance premiums can seem challenging, but with a few simple strategies, you can save money without sacrificing coverage. Here are 10 easy tips to help you cut costs:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates that fit your needs.

- Bundle Policies: Consider combining your auto insurance with other policies like home or renters insurance for discounts.

- Increase Deductibles: Opting for a higher deductible can lower your premium, but ensure you can afford the out-of-pocket costs in case of an accident.

- Maintain a Good Credit Score: Many insurers leverage credit scores when determining premiums, so keep your credit in good standing.

Continuing our list, you can further reduce your auto insurance costs by implementing these additional tips:

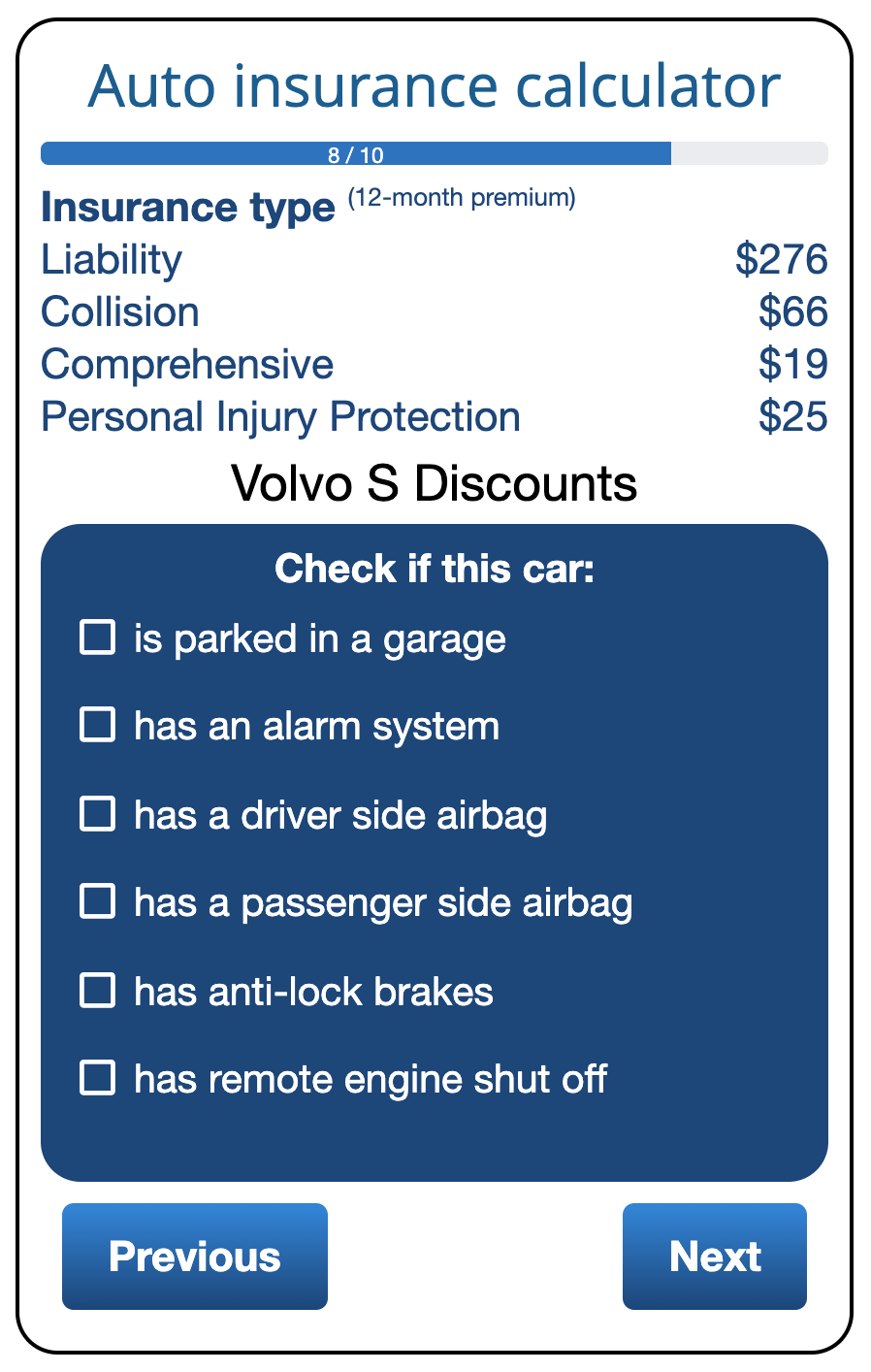

- Take Advantage of Discounts: Inquire about available discounts such as safe driver, good student, or low mileage.

- Choose Your Vehicle Wisely: Insurance costs depend greatly on your car's make and model; opt for a lower-risk vehicle.

- Install Safety Features: Adding features like anti-theft systems or automatic braking can lead to premium reductions.

- Review Your Coverage Annually: Regularly assess your policy to ensure it still meets your needs and to take advantage of any lower rates.

- Limit Coverage on Older Cars: For vehicles with low market value, consider dropping collision or comprehensive coverage to save on premiums.

Understanding the Factors That Determine Your Auto Insurance Rates

Understanding the factors that determine your auto insurance rates is essential for anyone looking to secure the best coverage at the most affordable price. Insurance companies evaluate a variety of criteria when calculating premiums, including your driving record, age, gender, and location. For instance, younger drivers often face higher rates due to their inexperience on the road, while drivers with a history of traffic violations may see their premiums increase significantly. Additionally, residing in an area with a higher crime rate could result in higher insurance costs, as the risk of theft or accidents is generally greater.

Other important factors include the type of vehicle you own, as cars with high safety ratings often qualify for discounts, and the coverage options you choose. For example, opting for a higher deductible can lower your monthly premium, but it also means more out-of-pocket expense in the event of a claim. Insurance scoring based on your credit history is another element that can influence rates, as insurers believe that good credit correlates with responsible driving. To get the best deal, it’s crucial to shop around and compare quotes from different providers while considering these various factors.

How Comparisons Can Save You Big on Auto Insurance: A Step-by-Step Guide

When it comes to managing expenses, auto insurance is often a significant line item in your budget. By taking the time to compare various policies, you can identify substantial savings. Start by gathering quotes from multiple providers. Many companies offer online tools that allow you to input your information and receive instant estimates. This step is crucial, as rates can vary widely depending on the insurer, your driving record, and the type of coverage you choose.

Once you have your quotes, it's essential to compare the coverage options offered by each provider. Not all policies are created equal, and the cheapest option may not always provide the protection you need. Create a simple table to track the different premiums, deductibles, and coverage limits for each company. By evaluating this information side by side, you can make an informed decision that not only saves you money but also ensures you have adequate coverage in case of an accident.