Blitz News Digest

Stay updated with the latest trends and insights.

Renters Insurance: Because Your Neighbor's Cat Could Ruin Your Day

Protect your stuff! Discover how renters insurance can save your day from unexpected mishaps—like your neighbor's cat causing chaos!

What Does Renters Insurance Cover: Protecting Yourself from Unexpected Events

Renters insurance is essential for anyone leasing a home or apartment, as it provides financial protection against unexpected events that could lead to significant losses. This type of insurance typically covers personal property in the event of theft, fire, or other disasters. For instance, if a fire were to damage your belongings, renters insurance would help you recover the cost of replacing items such as furniture, electronics, and clothing. Additionally, many policies include liability coverage, which helps protect you if someone is injured while visiting your home.

Aside from personal property and liability, renters insurance may also cover additional living expenses if you are forced to vacate your rented space due to a covered loss. This could include hotel bills, meals, and other costs associated with temporarily relocating. It's important to thoroughly review your policy to understand all the coverage options available to you. Always consider discussing your needs with an insurance agent to ensure you choose the best plan that provides comprehensive protection from unforeseen circumstances.

Do You Really Need Renters Insurance? Exploring the Benefits

When considering whether to invest in renters insurance, it’s important to understand what this coverage entails and how it can benefit you. Renters insurance provides financial protection against loss or damage to personal property within your rented space, whether it’s due to theft, fire, or vandalism. In many cases, landlords may require tenants to carry this type of insurance as part of the lease agreement, ensuring that both parties are shielded from potential financial setbacks. Furthermore, renters insurance can offer liability coverage, which protects you in case a guest is injured in your apartment and decides to seek damages.

Another compelling reason to consider renters insurance is the affordability it often provides. Premiums are typically modest, especially when you take into account the financial peace of mind that comes with knowing your belongings are protected. According to industry statistics, the average cost of renters insurance is often less than the price of a daily cup of coffee, making it an accessible option for most renters. Additionally, many insurers offer discounts for bundling policies or having security features in your home, allowing you to save even more. Ultimately, having renters insurance can be a sound investment that protects not just your possessions, but also your financial well-being.

How to Choose the Right Renters Insurance Policy for Your Needs

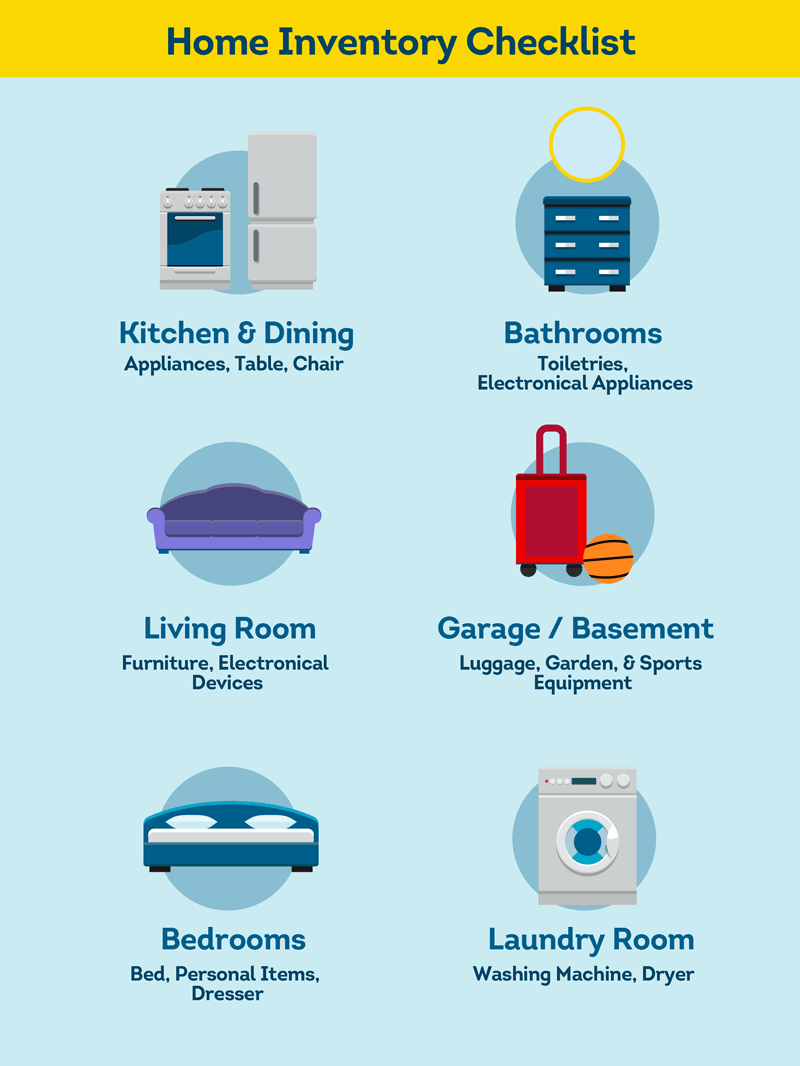

When it comes to selecting the right renters insurance policy, it's essential to start by assessing your specific needs. Consider the value of your personal belongings, such as electronics, furniture, and clothing, and determine how much coverage you'll require. Make a list of your possessions and their approximate worth to get a clearer picture. Additionally, evaluate the potential risks in your area, like natural disasters or high crime rates, which can influence the amount of coverage you need. This comprehensive assessment will serve as a solid foundation for your insurance shopping.

Next, familiarize yourself with the different types of renters insurance policies available. Typically, policies fall into two main categories: actual cash value and replacement cost coverage. Actual cash value policies factor in depreciation, meaning the payout might not cover the full cost of replacing your items. On the other hand, replacement cost policies cover the full amount necessary to replace your possessions without factoring in depreciation. Understanding these differences can help you choose a policy that best fits your needs and financial situation.