Blitz News Digest

Stay updated with the latest trends and insights.

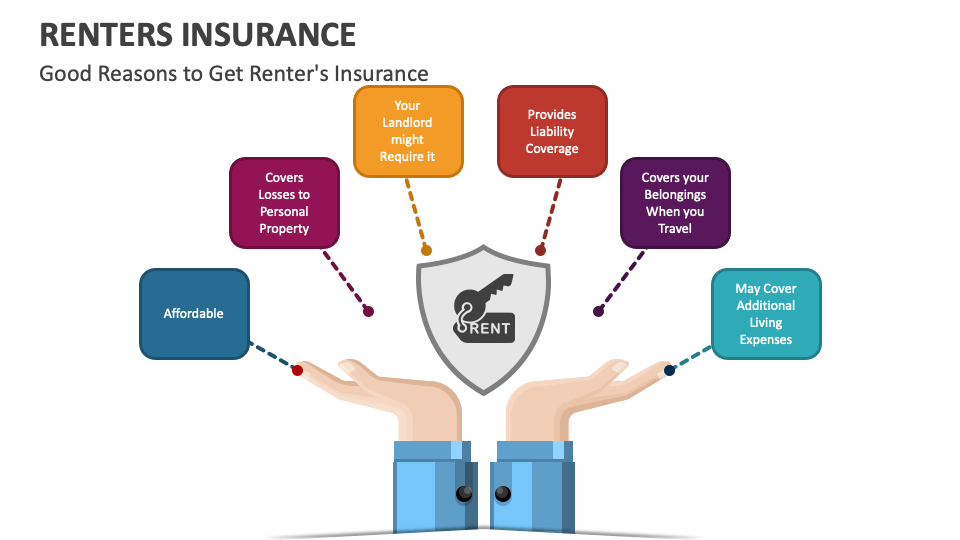

Don't Let Your Belongings Play Hide and Seek: Why Renters Insurance is a Must

Protect your prized possessions! Discover why renters insurance is essential to keep your belongings safe from unexpected surprises.

What Does Renters Insurance Really Cover?

Renters insurance is designed to provide essential protection for individuals who rent their homes. What does renters insurance really cover? Primarily, it covers personal property, meaning that if your belongings are damaged or stolen due to events like fire, theft, or vandalism, you're protected. This can include items such as furniture, electronics, and clothing. In addition to personal property, renters insurance often includes liability coverage, which protects you if someone is injured in your rented space or if you accidentally cause damage to someone else's property.

Moreover, renters insurance may also offer additional living expenses coverage. This means that if your rental unit becomes uninhabitable due to a covered disaster, your policy can help pay for temporary housing and other essential expenses. It's important to note that what renters insurance really covers can vary by policy, so it's crucial to read the fine print and understand the exclusions and limitations. Overall, having renters insurance can provide peace of mind, knowing that you’re safeguarded against unexpected events that could lead to financial hardship.

Top 5 Reasons You Need Renters Insurance Today

Renters insurance is essential for anyone who leases their living space, offering peace of mind and financial protection. Here are the top 5 reasons you need renters insurance today:

- Protection of Personal Belongings: Renters insurance covers personal property loss due to theft, fire, or water damage. Without it, you could face significant out-of-pocket expenses for replacing your valuables.

- Liability Coverage: Accidents can happen, and if someone is injured in your rental property, you could be held liable. Renters insurance provides liability coverage to protect you from potential legal costs.

- Additional Living Expenses: If your rental becomes uninhabitable due to damage, renters insurance can cover the cost of temporary housing, ensuring you have a place to stay while repairs are made.

- Affordability: Many people are surprised to find how affordable renters insurance can be. For a relatively low monthly premium, you can secure valuable protection and peace of mind.

- Landlord Requirements: Some landlords require tenants to carry renters insurance as part of their lease agreement, making it not only a wise choice but often a necessary one.

Is Your Stuff Protected? Understanding the Importance of Renters Insurance

When it comes to protecting your personal belongings, understanding the importance of renters insurance is crucial. Many people mistakenly believe that their landlord's insurance will cover their belongings in the event of theft, fire, or water damage. However, this is often not the case. Renters insurance provides coverage for personal property, safeguarding your items against unforeseen events. This typically includes clothing, electronics, and furniture, which can add up to significant financial loss if damaged or stolen. Investing in this type of insurance not only provides peace of mind but also ensures that you can replace or repair your belongings without crippling your finances.

Moreover, renters insurance often includes liability coverage, which protects you in case someone gets injured while visiting your home. Imagine the hefty expenses that could arise from medical bills or legal fees if an accident were to occur. With renters insurance, you can focus on enjoying your living space without the constant worry of potential liabilities. For these reasons, purchasing renters insurance is not just a smart financial decision; it is an essential step in ensuring that your assets and your future are adequately protected.