Blitz News Digest

Stay updated with the latest trends and insights.

The Quirky Side of Home Insurance You Never Knew

Discover the surprising and quirky facts about home insurance that could save you money and give you a good laugh! Don't miss out!

Uncovering the Unexpected: 5 Wacky Home Insurance Claims That Will Make You Laugh

When it comes to home insurance, most people expect to hear about claims related to fire or water damage. However, uncovering the unexpected reveals that the world of home insurance can be delightfully bizarre! In this article, we explore five wacky home insurance claims that will not only surprise you but also make you chuckle. From strange animal encounters to unbelievable household accidents, these claims paint a vivid picture of the quirks that can arise in everyday life.

- The Squirrel Situation: One policyholder filed a claim after a squirrel decided to invade their home, causing chaos by nesting in their attic and chewing through wires. The homeowner had to call an exterminator, a handy person, and the insurance agency for the repairs, leading to an unexpectedly hefty bill.

- The Surprise Homeowner: Another amusing claim involved a homeowner who discovered their living room had become a racetrack for local geese! These feathered friends took a liking to the yard, but one particularly determined goose managed to crash through the front door.

- Kitchen Catastrophe: One homeowner tried to impress their friends with a culinary masterpiece, only for the kitchen experiment to go awry. A small grease fire led to smoke damage throughout the home—an outcome that turned a fun dinner party into a wacky insurance claim.

Is Your Pet a Risk? How Furry Friends Can Impact Your Home Insurance Premium

When considering your home insurance policy, it’s essential to recognize that your furry friends can significantly influence your premiums. Insurance providers often assess various factors when determining rates, and the type of pet you own is one of them. For instance, certain breeds of dogs are perceived as higher risk due to their predisposition to aggressive behavior, which can lead to potential liabilities. Understanding how your pet impacts your home insurance can save you money in the long run and help you make informed choices about pet ownership.

Moreover, claims related to pets, such as dog bites or property damage caused by mischievous animals, can be costly for insurance companies and may lead to increased premiums. If you’re a pet owner, it’s advisable to disclose this information to your insurer to avoid potential issues down the line. Developing responsible pet ownership habits, such as training and socialization, can not only benefit your relationship with your pet but also help in maintaining a favorable home insurance rate. In conclusion, being aware of how furry friends can impact your home insurance premium is crucial for every pet owner.

Home Insurance Myths Busted: What You Thought You Knew Might Surprise You

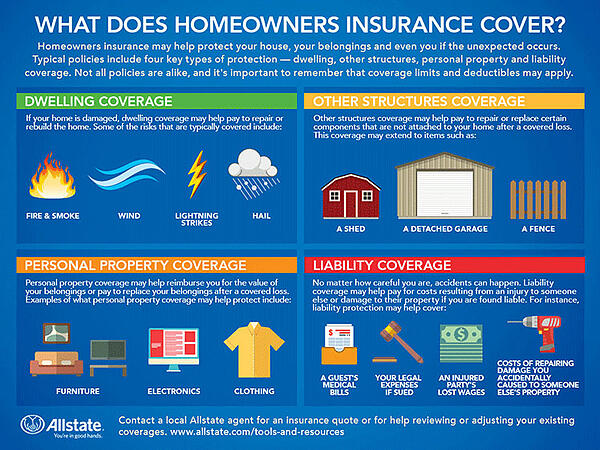

Home insurance is surrounded by numerous myths that can lead homeowners to make costly mistakes. One common myth is that home insurance covers all types of damage. In reality, many policies have exclusions for specific events, such as flooding or earthquakes. Therefore, it’s crucial to understand what your policy includes and if you need additional coverage for certain risks. Ignoring this detail could leave you vulnerable to significant financial loss.

Another prevalent misconception is that claiming home insurance will always result in higher premiums. While it’s true that some claims can impact your rates, this is not a universal rule. In fact, if a significant event occurs, such as a natural disaster, the overall risk pool may not change significantly because many homeowners are affected. It’s essential to weigh the benefits of filing a claim against potential rate increases, considering that your peace of mind and financial safety often take priority.