Blitz News Digest

Stay updated with the latest trends and insights.

Price Wars: Who’s Really Got Your Back in Insurance?

Uncover the truth behind insurance price wars! Discover who truly has your back in this competitive market and save big.

Understanding Insurance Price Wars: Key Factors That Impact Your Premiums

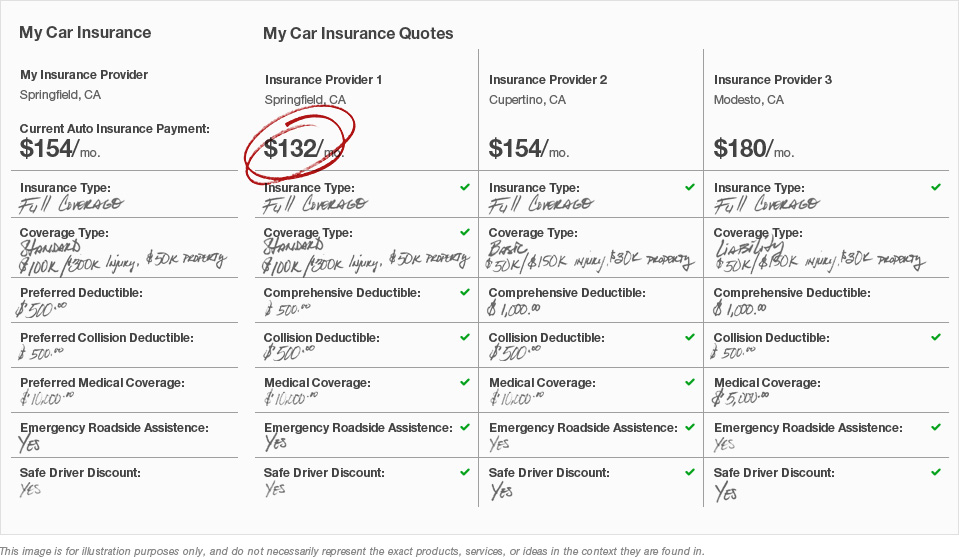

The insurance industry is often characterized by fierce price wars, driving premiums lower for consumers, but the factors influencing these fluctuations can be complex. Understanding Insurance Price Wars involves examining how competition among providers, market demand, and individual risk assessments come into play. When multiple companies vie for the same clientele, they may offer discounted rates or incentives to attract and retain customers. This competitive nature not only benefits consumers but can also lead to significant disparities in pricing and coverage options.

Several key factors will impact your insurance premiums, including your age, driving record, and credit history. Key Factors That Impact Your Premiums also include the type of coverage you select and the value of your insured assets. For instance, opting for higher deductibles can lower your premium, but it also means you’ll pay more out-of-pocket in the event of a claim. Additionally, insurers utilize various algorithms and models to assess risk, which plays a crucial role in determining how much you will ultimately pay for coverage.

The Real Cost of Insurance Discounts: Are You Getting What You Pay For?

The real cost of insurance discounts can often be obscured by attractive promotional offers. Many consumers are lured in by the prospect of savings on their premiums, but it's essential to delve deeper into what these discounts actually entail. While a lower price can initially seem like a great deal, it may come with strings attached. For instance, insurance companies might sacrifice coverage limits or increase deductibles, ultimately increasing the financial risk to the policyholder. Thus, it’s crucial to analyze the terms of these discounts and understand all associated costs before committing.

Moreover, the hidden costs of insurance discounts can manifest in unexpected ways. Often, low-priced policies may not provide adequate support during claims, leaving policyholders vulnerable when they need assistance the most. It's vital to consider factors like customer service, claims handling, and the company's overall reputation when evaluating discount policies. As a consumer, asking the right questions and conducting thorough research can empower you to make informed decisions, ensuring that you truly understand what you pay for when opting for insurance discounts.

Navigating the Insurance Landscape: How to Choose the Right Coverage Amid Price Wars

Navigating the insurance landscape can be particularly challenging, especially during periods of intense price wars among providers. When selecting the right coverage, it’s essential to consider not just the cost but also the value of the coverage itself. Start by assessing your specific needs:

- Evaluate your risks: Understand what you need to protect.

- Compare policies: Look beyond the premiums to see what each policy actually offers.

- Consult with an expert: An insurance agent can help clarify options and tailor coverage.

Another crucial factor to consider is the reputation and reliability of the insurers you are considering. Reading customer reviews and checking financial stability ratings can provide insight into their performance and claims-handling process. Remember, the cheapest policy might not always offer the best coverage. Therefore, it’s vital to:

- Assess customer service: A supportive claims process can make a significant difference.

- Look for discounts: Many insurers offer savings on bundles or safe driving.

- Revisit your coverage periodically: Your needs may change, and so should your policy.