Blitz News Digest

Stay updated with the latest trends and insights.

Insurance Showdown: Your Wallet and the Policy Duel

Uncover the ultimate insurance showdown! Discover how to safeguard your wallet and navigate the policy duel like a pro!

Understanding Your Insurance Needs: What Policy Is Right for You?

Understanding your insurance needs is crucial in ensuring that you have the right coverage for your specific situation. Insurance can come in many forms—health, auto, home, life, and more—each designed to protect different aspects of your life. Start by assessing your current circumstances, such as your financial situation, family needs, and potential risks you might encounter. Consider factors like your lifestyle, the value of your assets, and your long-term goals. By answering these questions, you can better understand which type of policy will provide you with the optimal coverage.

Once you have a clear picture of your needs, it's time to explore insurance policies that align with those needs. Here are some key steps to narrow down your options:

- Research different types of coverage: Look into various policies available in the market.

- Compare quotes: Obtain quotes from multiple providers to ensure you're getting competitive rates.

- Read reviews: Look for customer feedback on claims processes and service quality.

- Consult with an expert: If you're unsure, seeking advice from an insurance agent can help you make a more informed decision.

By following these steps, you can confidently select the insurance policy that best fits your requirements.

The True Cost of Coverage: Are You Paying Too Much?

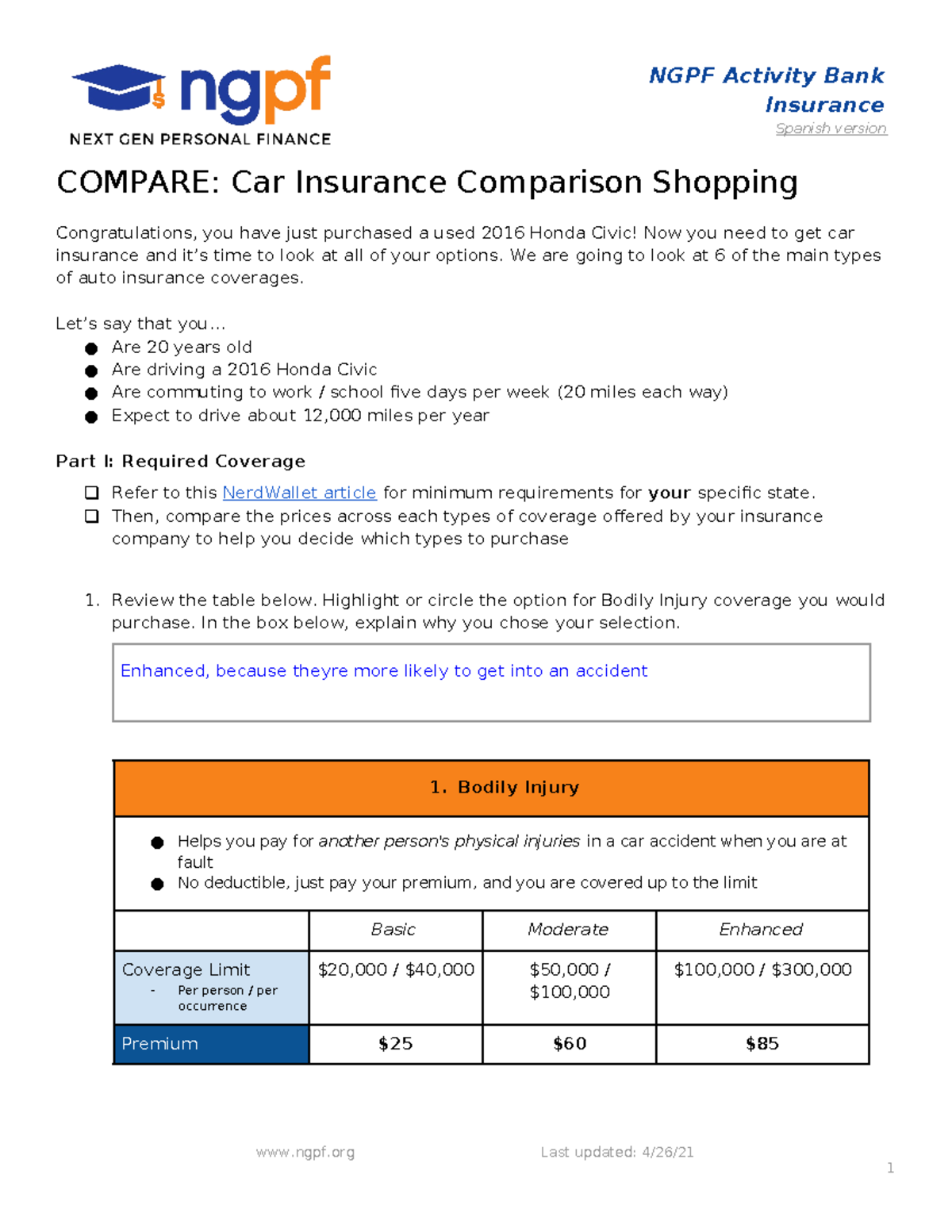

When it comes to insurance, understanding the true cost of coverage is essential for making informed financial decisions. Many individuals and businesses often find themselves overpaying for policies that may not offer the level of protection they truly need. Factors such as coverage limits, deductibles, and excluded risks can significantly impact your premiums. To evaluate your current plan, consider creating a detailed list of your coverage needs and comparing them to what you are currently paying. This process can help you identify areas where you might be spending unnecessarily.

Additionally, it's important to regularly review your policies and seek quotes from multiple providers. Are you paying too much? This question can often lead to astounding revelations about your current coverage. Many consumers stick with the same insurer out of habit rather than necessity, potentially paying hundreds—or even thousands—of dollars more than necessary. By shopping around and consulting with financial advisors, you can uncover more tailored options that align better with your risk profile and budget, ultimately ensuring that you're not only covered but also receiving the best value for your money.

Insurance Quality vs. Price: Finding the Perfect Balance for Your Budget

When it comes to choosing insurance, quality and price are two critical factors that often compete for attention. While it's tempting to opt for the cheapest policy available, this approach can lead to significant pitfalls down the line. Quality insurance typically offers better coverage, more comprehensive benefits, and enhanced customer service. To determine the right balance, take the time to assess your personal needs, including factors such as coverage options, deductibles, and the claims process. Comparing quotes from various providers will help you understand how much you can expect to pay for adequate coverage without sacrificing quality.

Moreover, finding the perfect balance between insurance quality and price involves recognizing that a lower premium might not always equate to better value. Consider creating a list that compares essential features among different policies, focusing on aspects such as:

- Financial stability of the insurer

- Customer reviews and ratings

- Claims settlement ratio

- Add-on services offered

By prioritizing these elements, you can make a more informed decision that suits your financial constraints while still ensuring you receive the coverage you need. Remember, the goal is to find an insurance policy that provides peace of mind without breaking the bank.