Blitz News Digest

Stay updated with the latest trends and insights.

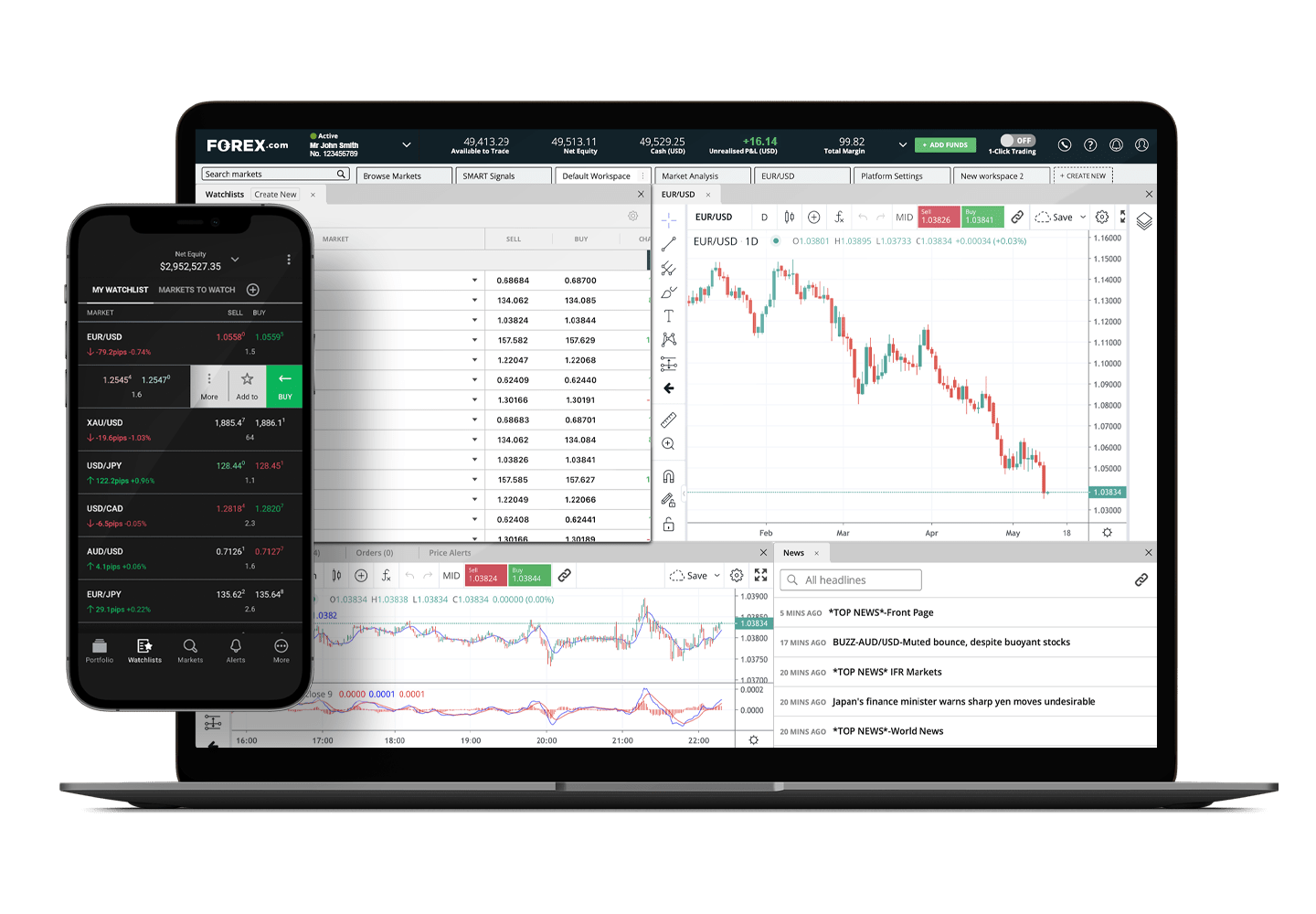

How to Ride the Currency Wave Like a Pro

Master the art of currency trading and ride the wave to profits! Discover insider tips and strategies for success. Dive in now!

Top Strategies for Navigating Currency Fluctuations

Navigating currency fluctuations effectively is crucial for businesses and investors alike, as these changes can significantly impact profit margins and investment returns. One of the top strategies is to implement **hedging techniques**, which can help safeguard against potential losses due to adverse currency movements. For instance, using financial instruments like futures or options can create a buffer, allowing businesses to lock in exchange rates and mitigate risks associated with volatility.

Another essential strategy involves staying informed about global economic indicators that influence currency movements. Regularly reviewing factors such as interest rates, inflation, and geopolitical developments can provide valuable insights into potential currency trends. Furthermore, diversifying your investments across different currencies and markets can reduce exposure to any single currency's fluctuation, ultimately strengthening your overall financial position. By adopting these methodologies, you can better navigate the complexities of currency fluctuations and protect your investments over time.

What Are the Key Factors Influencing Currency Markets?

The currency markets are influenced by a variety of factors that can impact exchange rates. Among the most significant are interest rates, which are set by central banks and play a crucial role in determining the attractiveness of a currency. When a central bank raises interest rates, it often leads to an appreciation of that currency, as higher rates offer better returns on investments denominated in that currency. Other factors include inflation rates, where lower inflation typically leads to a stronger currency, and economic indicators such as GDP growth that reflect a country's overall economic health.

Additionally, political stability and economic performance can greatly influence currency values. Countries with strong, stable governments and robust economies tend to attract more foreign investment, increasing demand for their currency. Market sentiment also plays a key role; traders' perceptions and reactions to news events can lead to swift fluctuations in currency prices. Other factors, including trade balances and global market trends, further contribute to the complex dynamics of the currency markets, illustrating the multifaceted nature of these financial systems.

Mastering Forex Trading: Tips from the Pros

Mastering Forex trading requires a deep understanding of market dynamics and the ability to analyze economic indicators. Professionals in the field emphasize the importance of developing a solid trading plan, which includes setting clear goals and risk management strategies. Consider adopting methods such as technical analysis and fundamental analysis to inform your trading decisions. Here are some essential tips from seasoned traders:

- Stay informed about global economic news and events.

- Utilize demo accounts to practice and refine your trading strategies.

- Always keep emotions in check to avoid impulsive decisions.

Another critical aspect of mastering Forex trading is continuous learning. The financial markets are ever-evolving, and what works today might not work tomorrow. Successful traders often recommend joining online forums or trading communities to share insights and learn from one another. Additionally, keeping a trading journal is vital for tracking your progress and identifying areas for improvement. Remember, the path to becoming a proficient Forex trader requires patience, discipline, and a commitment to personal growth.