Blitz News Digest

Stay updated with the latest trends and insights.

Gold Rush: Why Everyone's Turning Their Eyes to Gold Trading

Discover why gold trading is capturing everyone's attention! Uncover secrets, trends, and tips to strike it rich in the modern gold rush!

The Rise of Gold Trading: What You Need to Know

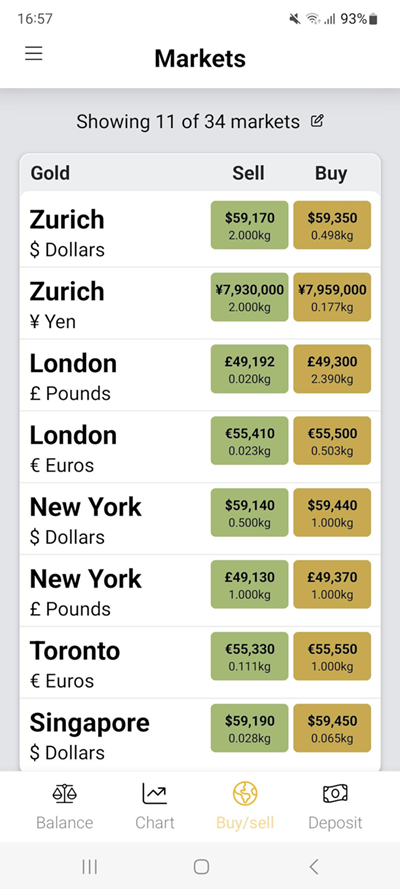

The global financial landscape is experiencing a significant shift, leading to a remarkable rise of gold trading. Investors are increasingly turning to precious metals as a reliable store of value, especially in times of economic uncertainty. Several factors are contributing to this trend, including inflation concerns, geopolitical tensions, and the ongoing fluctuations in traditional stock markets. As a result, many individuals and institutions are reallocating their portfolios to include gold, recognizing its historical significance and potential for safeguarding wealth.

For those interested in entering the world of gold trading, understanding the various avenues available is crucial. Investors can choose from a range of options, including physical gold (such as coins and bars), gold exchange-traded funds (ETFs), and futures contracts. Each method comes with its own set of advantages and risks. It is essential to conduct thorough research and consider consulting with a financial advisor to make informed decisions. As the demand for gold continues to rise, staying informed about market trends and trading strategies will be key to maximizing potential gains.

Is Gold the Safe Haven Asset Everyone is Talking About?

In times of economic uncertainty, investors often turn to gold as a safe haven asset. This precious metal has been regarded for centuries as a reliable store of value, particularly during inflationary periods or geopolitical tensions. Gold tends to maintain its value when traditional investments, such as stocks and bonds, may be more volatile. As a tangible asset, it provides a sense of security in a world where financial markets can fluctuate wildly, making it an appealing choice for those looking to protect their wealth.

However, it's important to consider both the benefits and drawbacks of investing in gold. While it can serve as a hedge against market instability, gold does not generate income like dividend-paying stocks or interest-bearing bonds. Additionally, the price of gold can experience significant fluctuations based on factors such as supply and demand, currency strength, and global economic indicators. Understanding these dynamics is crucial when evaluating whether gold truly is the safe haven asset everyone is talking about.

Top Strategies for Successful Gold Trading in Today's Market

With the rising interest in precious metals, successful gold trading requires a solid strategy tailored to today's dynamic market. One effective approach is to stay informed about global economic indicators that can influence gold prices. Key factors to monitor include inflation rates, interest rates, and geopolitical tensions. By understanding how these elements interact, traders can make more informed decisions and time their trades effectively. Additionally, utilizing technical analysis can help identify trends and price levels, providing a clearer roadmap for potential market movements.

Another crucial strategy for profitable gold trading is to diversify your investment portfolio. Rather than putting all funds into one type of gold asset, consider spreading your investment across various avenues, such as gold mining stocks, ETFs, and physical gold. This diversification can mitigate risks and enhance potential returns. Furthermore, setting clear goals and maintaining discipline in trading can prevent emotional decision-making, helping traders remain focused on long-term profitability in the volatile gold market.