Blitz News Digest

Stay updated with the latest trends and insights.

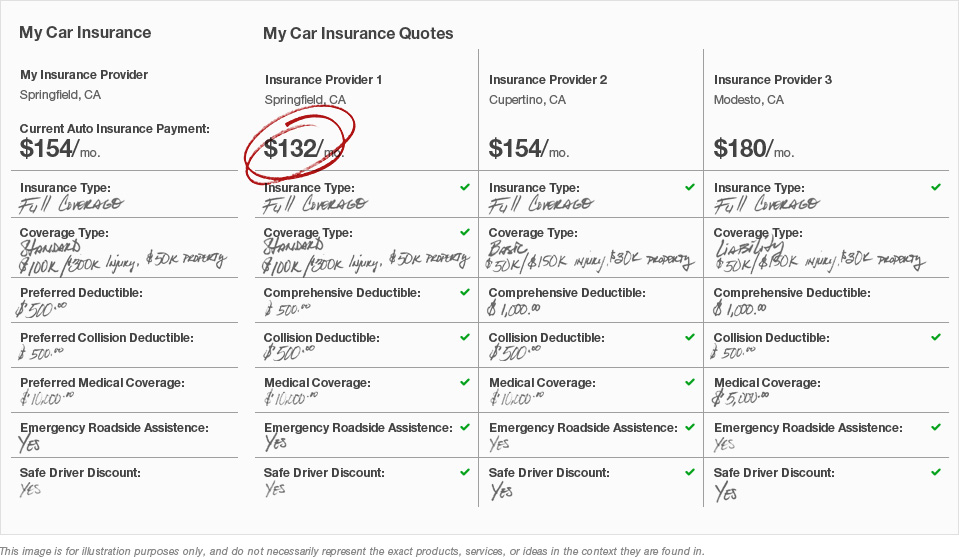

Dodge the Duds: Your Go-To Insurance Comparison!

Discover the best insurance deals! Dodge the duds and save big with our easy comparison tool. Your wallet will thank you!

Understanding the Benefits of Insurance Comparison: Why It Matters

Understanding the benefits of insurance comparison is crucial for consumers seeking the best coverage at the most competitive rates. One of the primary advantages is the ability to assess various policies side by side, which enables individuals to identify unique features and coverage options that may not be readily apparent when looking at a single provider. By actively comparing insurance plans, consumers can save money, avoid unnecessary coverage, and make informed decisions tailored to their specific needs. Moreover, with the plethora of options available in today’s market, the significance of thorough insurance comparison cannot be overstated.

Additionally, insurance comparison empowers consumers with knowledge, allowing them to navigate the complexities of different policies confidently. With access to user-friendly comparison tools, individuals can easily evaluate premiums, deductibles, and policy limits. The process also encourages healthy competition among insurance providers, often leading to better pricing and innovative offerings. In summary, understanding the benefits of insurance comparison not only enhances the buying experience but also fosters a sense of assurance that comes from making well-informed choices that ensure both financial security and peace of mind.

5 Essential Questions to Ask Before Choosing Your Insurance Provider

Choosing the right insurance provider is a critical decision that can impact your financial security. Before making this choice, consider asking these 5 essential questions to ensure you find a provider that meets your needs. First, inquire about the range of coverage options available. Understanding the types of insurance policies they offer—whether it's auto, home, health, or life insurance—can help you assess if the provider can cater to your specific requirements. Secondly, it's important to ask about the claims process. A provider with a straightforward and efficient claims procedure can save you considerable time and stress during challenging situations.

Another vital question involves understanding the provider's financial stability. Researching their ratings from agencies can give you insight into their ability to pay out claims, which is crucial when you need them the most. Fourthly, seek clarity on premiums and deductibles. A detailed explanation of your potential out-of-pocket expenses will help you budget effectively. Lastly, consider asking about customer support and service. A provider that offers accessible and responsive customer service can make your experience much smoother. By focusing on these key questions, you'll be well-equipped to choose the best insurance provider for your needs.

How to Spot Hidden Fees and Duds in Insurance Policies

When navigating the complex world of insurance, it’s crucial to spot hidden fees that could inflate your policy costs considerably. Start by carefully reviewing the policy document's fine print. Look for terms like "administrative fees," "brokerage fees," or "service charges." Many insurers may bury these charges, making them difficult to spot. To help you, consider creating a checklist of common hidden fees and their definitions, so you know what to watch for.

Additionally, be wary of duds or inadequate coverage options in your insurance policy. It’s essential to evaluate what is and isn't covered. Conduct a thorough comparison of similar policies, focusing on coverage limits, exclusions, and deductibles. If a policy seems too cheap, it might be a dud that won’t adequately protect you when you need it most. Ask your agent for clarification on any ambiguous clauses, and don’t hesitate to request adjustments to ensure your policy meets your needs.