Blitz News Digest

Stay updated with the latest trends and insights.

Renters Insurance: Your Secret Weapon Against the Unexpected

Unlock peace of mind with renters insurance! Discover how it protects you from life's surprises and keeps your belongings safe.

Understanding Renters Insurance: What It Covers and Why You Need It

Renters insurance is a type of property insurance designed to protect tenants and their belongings in rented properties. It typically covers personal property loss or damage due to events like fire, theft, or vandalism. For instance, if your laptop is stolen from your apartment, renters insurance can help replace it. Additionally, renters insurance often includes liability coverage, which can protect you in case someone is injured while visiting your home. Understanding what is covered under your policy is crucial for securing your financial well-being and peace of mind.

Having renters insurance is not only a smart financial decision but sometimes a requirement by landlords. Without it, you may be financially vulnerable in the event of unexpected incidents. For example, if a fire damages your apartment and displaces you, renters insurance can cover additional living expenses while you find a new place. Furthermore, many policies offer additional services such as medical payments for injuries that occur on your property, making it a wise investment for any renter. Overall, the right renters insurance policy can provide a safety net that safeguards your financial future.

Five Common Misconceptions About Renters Insurance Debunked

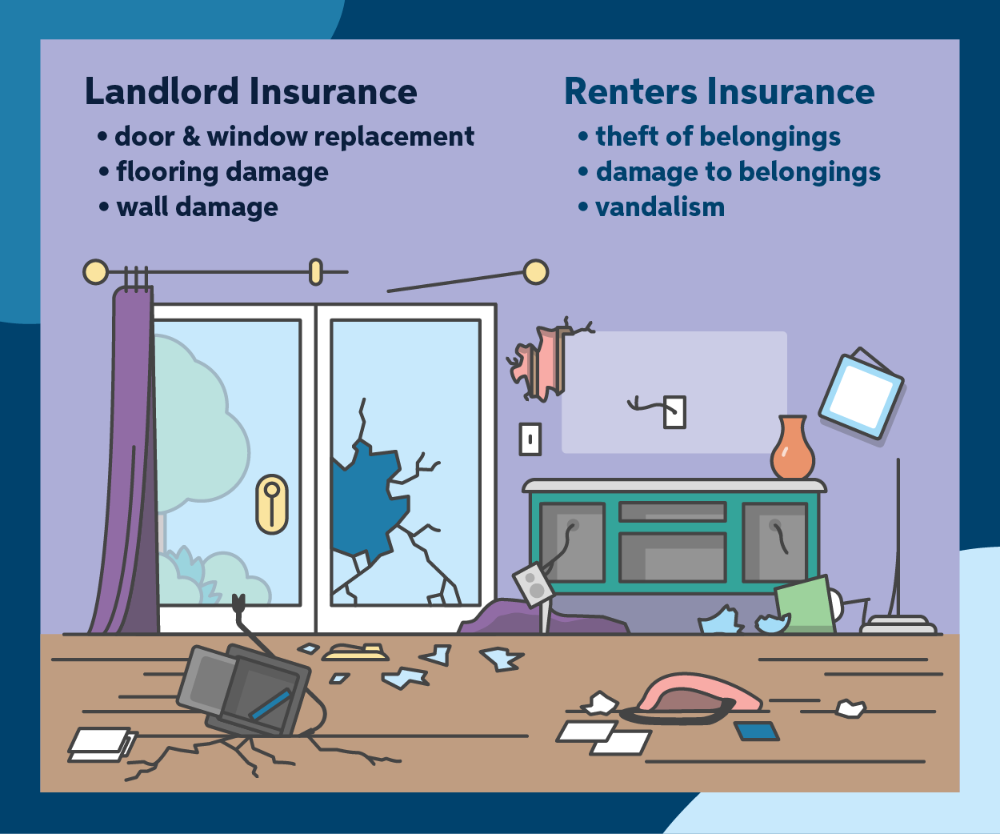

Many people believe that renters insurance is an unnecessary expense, thinking their landlord’s insurance covers their personal belongings. However, it’s important to note that landlord insurance typically only protects the building itself and their own liabilities, not your personal items. According to surveys, a significant percentage of renters are unaware that their electronics, furniture, and clothing are not covered under their landlord's policy. A relatively small monthly premium can protect against loss from theft, fire, or other disasters, making it a smart investment for anyone renting a home.

Another common misconception is that renters insurance is only for individuals with high-value possessions. In reality, even modest households can accumulate a substantial amount of belongings worth hundreds or thousands of dollars. It’s essential to evaluate what you own—furniture, appliances, clothes, and other personal items—and understand that these possessions add up. Additionally, renters insurance often includes liability coverage, which can be invaluable in situations where you may be held responsible for damage to someone else's property or injuries sustained in your rental unit.

Do You Really Need Renters Insurance? Here’s What You Should Consider

Considering whether you really need renters insurance is essential for anyone leasing a property. Many renters believe that their landlord's insurance covers their belongings, but that is not the case. Landlord insurance typically only protects the building itself and not the personal belongings of tenants. Without renters insurance, you could face significant financial loss in the event of theft, fire, or other disasters that may damage your personal property. In fact, according to industry statistics, over 70% of renters do not have sufficient coverage, leaving them vulnerable and unprotected.

When contemplating renters insurance, it's critical to assess your personal situation and the value of your possessions. Begin by creating an inventory of your belongings and estimating their worth. This can help you identify the level of coverage you'll need. Additionally, evaluate where you live; areas prone to natural disasters may necessitate more comprehensive coverage. Ultimately, weighing the cost of renters insurance against the potential loss of valuables can be invaluable in making your decision. In many cases, the peace of mind that comes with being insured proves to be well worth the expense.