Blitz News Digest

Stay updated with the latest trends and insights.

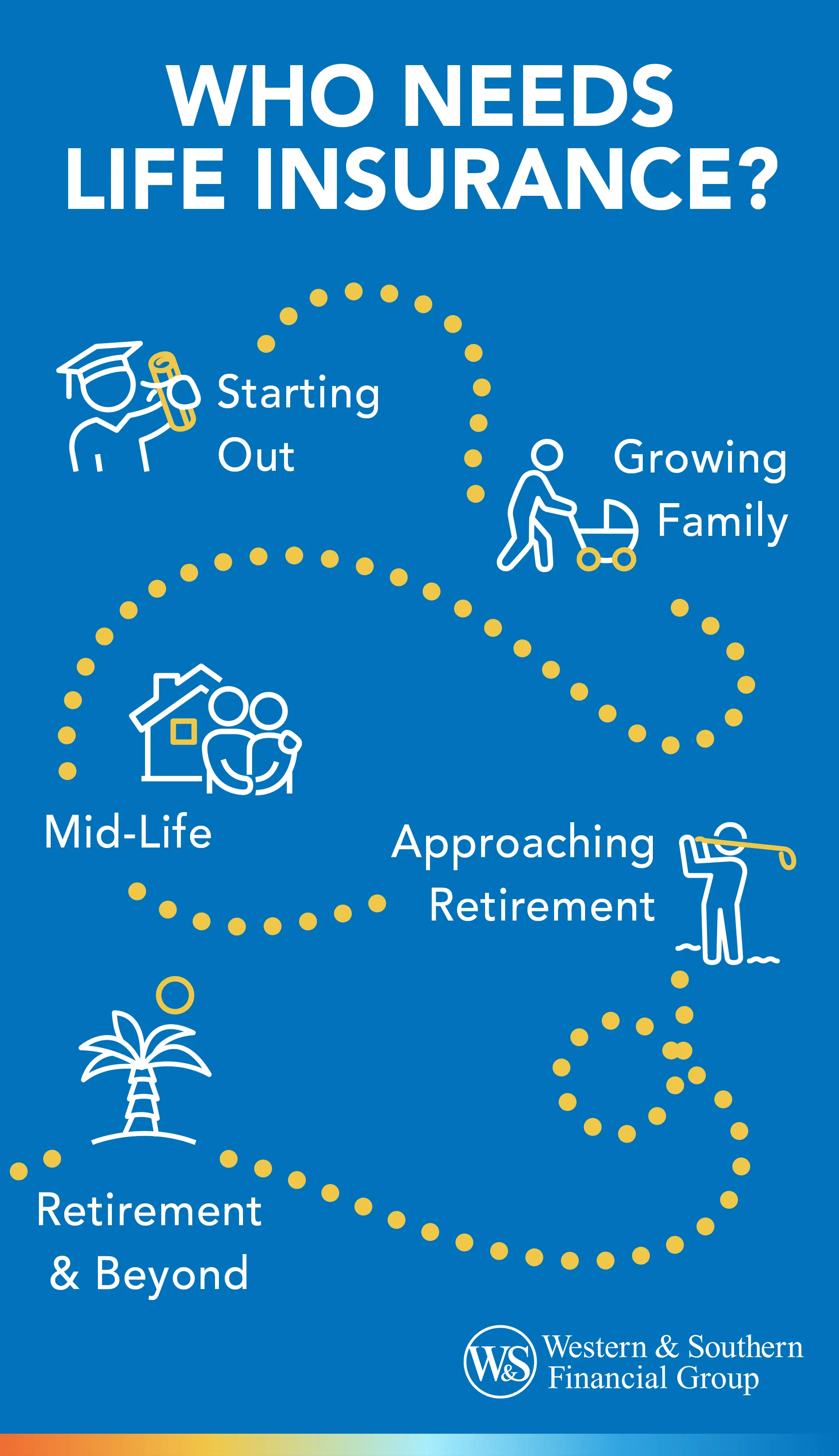

Life Insurance: The Safety Net You Didn't Know You Needed

Discover why life insurance is the ultimate safety net for you and your loved ones. Don't miss out on this essential protection!

Understanding the Basics of Life Insurance: What You Need to Know

Understanding the basics of life insurance is essential for anyone looking to secure their financial future. At its core, life insurance is a contract between you and an insurance company that pays out a designated sum of money to your beneficiaries upon your death. This can provide significant financial support during a challenging time, helping to cover expenses such as mortgage payments, college tuition, and other debts. There are various types of life insurance policies available, including term life, whole life, and universal life, each with its own benefits and costs. By grasping these fundamentals, you can make an informed decision that aligns with your financial goals.

When considering life insurance, it’s important to evaluate your individual needs and circumstances. Start by assessing the financial responsibilities you have, including any dependents or outstanding debts. A quick guide to determining coverage needs could include factors such as:

- Current income and future income potential

- Outstanding debts and mortgages

- Educational expenses for children

- Final expenses and funeral costs

By taking the time to understand these key elements, you can choose a policy that offers adequate protection for your loved ones, ensuring that they are financially stable long after you are gone.

Is Life Insurance Worth It? Debunking Common Myths

When considering whether life insurance is worth it, many people are met with a barrage of myths that can cloud their judgment. One common misconception is that life insurance is only necessary for those with dependents. In reality, even single individuals or those without children can greatly benefit from having a policy in place. For example, it can cover funeral expenses and outstanding debts, providing peace of mind for loved ones left behind. Additionally, purchasing a policy at a younger age often results in lower premiums, making it a wise financial decision.

Another prevalent myth is that life insurance is too expensive for the average person. In fact, many affordable options are available, including term life insurance, which offers coverage for a specific period at a lower cost than whole life policies. It's essential to assess your personal situation and needs; a policy can offer significant financial security for the future. Ultimately, understanding these myths is crucial to making an informed decision about life insurance and whether it truly fits into your financial plan.

How Life Insurance Can Be a Financial Safety Net for Your Family

Life insurance serves as a crucial financial safety net, providing peace of mind for families during uncertain times. In the event of an unexpected tragedy, having a life insurance policy ensures that your loved ones are financially protected. This financial windfall can cover essential expenses such as mortgage payments, daily living costs, and children's education. By securing a life insurance policy, you're not only safeguarding your family's immediate needs but also investing in their future stability.

Moreover, a life insurance policy can facilitate long-term financial planning. It can act as an essential tool in estate planning, helping to cover debts and taxes, thereby preserving your family's wealth. Additionally, benefits from a life insurance policy can be utilized as an investment vehicle, offering potential cash value that can grow over time. As you consider your financial strategies, remember that choosing the right life insurance not only protects your family's future but also reinforces your commitment to their well-being.